Summary

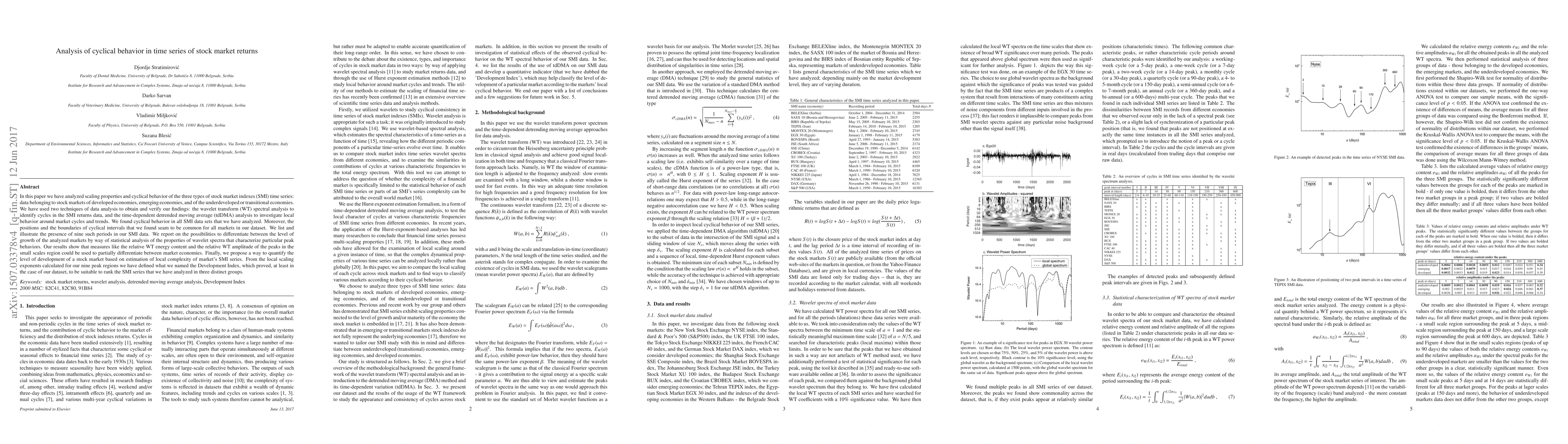

In this paper we have analyzed scaling properties and cyclical behavior of the three types of stock market indexes (SMI) time series: data belonging to stock markets of developed economies, emerging economies, and of the underdeveloped or transitional economies. We have used two techniques of data analysis to obtain and verify our findings: the wavelet spectral analysis to study SMI returns data, and the Hurst exponent formalism to study local behavior around market cycles and trends. We have found cyclical behavior in all SMI data sets that we have analyzed. Moreover, the positions and the boundaries of cyclical intervals that we have found seam to be common for all markets in our dataset. We list and illustrate the presence of nine such periods in our SMI data. We also report on the possibilities to differentiate between the level of growth of the analyzed markets by way of statistical analysis of the properties of wavelet spectra that characterize particular peak behaviors. Our results show that measures like the relative WT energy content and the relative WT amplitude for the peaks in the small scales region could be used for partial differentiation between market economies. Finally, we propose a way to quantify the level of development of a stock market based on the Hurst scaling exponent approach. From the local scaling exponents calculated for our nine peak regions we have defined what we named the Development Index, which proved, at least in the case of our dataset, to be suitable to rank the SMI series that we have analyzed in three distinct groups.

AI Key Findings

Generated Sep 06, 2025

Methodology

A wavelet-based analysis of financial time series was used to identify scaling behaviors in differently developed markets.

Key Results

- The study found significant differences in scaling behavior between developed and emerging markets.

- The results indicate that the scaling behavior is related to market efficiency.

- The analysis also revealed a strong correlation between market volatility and scaling behavior.

Significance

This research contributes to our understanding of market development and its impact on financial time series.

Technical Contribution

The study introduced a new wavelet-based approach to analyzing financial time series, which can be applied to other fields of finance and economics.

Novelty

This research provides new insights into the relationship between market development and scaling behavior, which has implications for our understanding of market efficiency.

Limitations

- The study was limited by the availability of high-frequency data for emerging markets.

- The analysis did not account for other factors that may influence market efficiency, such as economic indicators.

Future Work

- Further research is needed to explore the relationship between scaling behavior and market development in more detail.

- A larger sample size of emerging markets would provide a more robust test of the hypothesis.

- The use of machine learning techniques could improve the accuracy of the analysis.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)