Summary

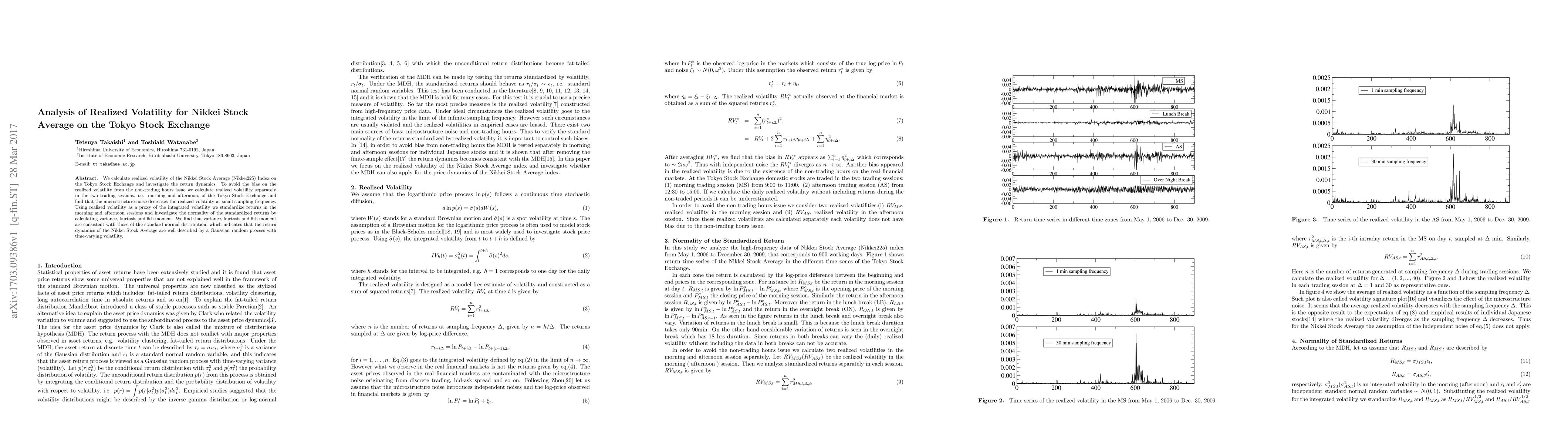

We calculate realized volatility of the Nikkei Stock Average (Nikkei225) Index on the Tokyo Stock Exchange and investigate the return dynamics. To avoid the bias on the realized volatility from the non-trading hours issue we calculate realized volatility separately in the two trading sessions, i.e. morning and afternoon, of the Tokyo Stock Exchange and find that the microstructure noise decreases the realized volatility at small sampling frequency. Using realized volatility as a proxy of the integrated volatility we standardize returns in the morning and afternoon sessions and investigate the normality of the standardized returns by calculating variance, kurtosis and 6th moment. We find that variance, kurtosis and 6th moment are consistent with those of the standard normal distribution, which indicates that the return dynamics of the Nikkei Stock Average are well described by a Gaussian random process with time-varying volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)