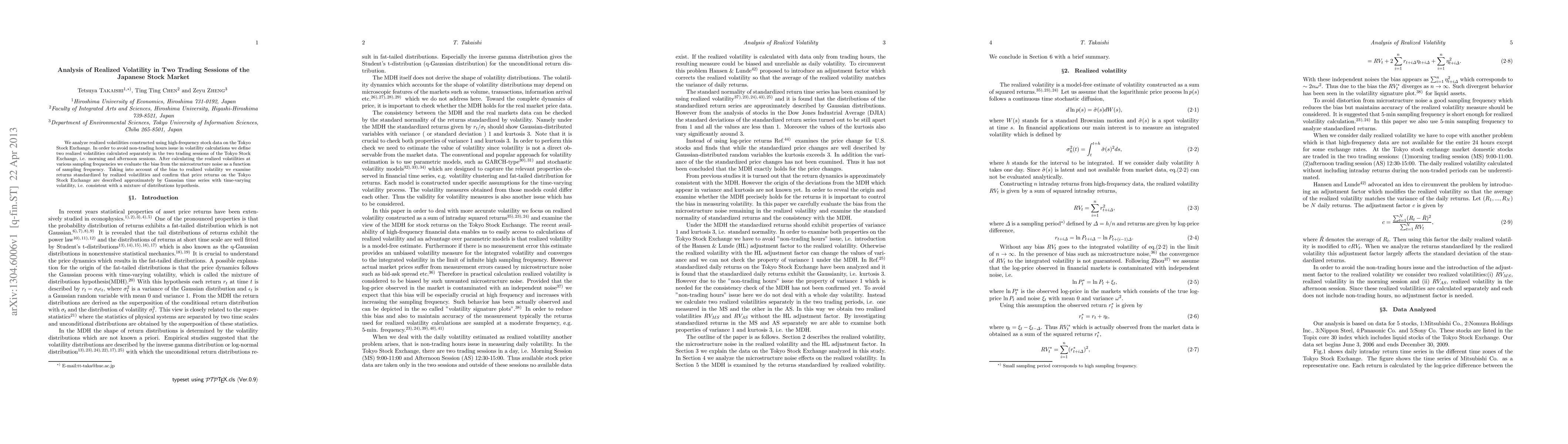

Summary

We analyze realized volatilities constructed using high-frequency stock data on the Tokyo Stock Exchange. In order to avoid non-trading hours issue in volatility calculations we define two realized volatilities calculated separately in the two trading sessions of the Tokyo Stock Exchange, i.e. morning and afternoon sessions. After calculating the realized volatilities at various sampling frequencies we evaluate the bias from the microstructure noise as a function of sampling frequency. Taking into account of the bias to realized volatility we examine returns standardized by realized volatilities and confirm that price returns on the Tokyo Stock Exchange are described approximately by Gaussian time series with time-varying volatility, i.e. consistent with a mixture of distributions hypothesis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGlobal Stock Market Volatility Forecasting Incorporating Dynamic Graphs and All Trading Days

Junbin Gao, Chao Wang, Zhengyang Chi

Forecasting realized volatility in the stock market: a path-dependent perspective

Sicheng Fu, Shaopeng Hong, Xiangdong Liu

| Title | Authors | Year | Actions |

|---|

Comments (0)