Summary

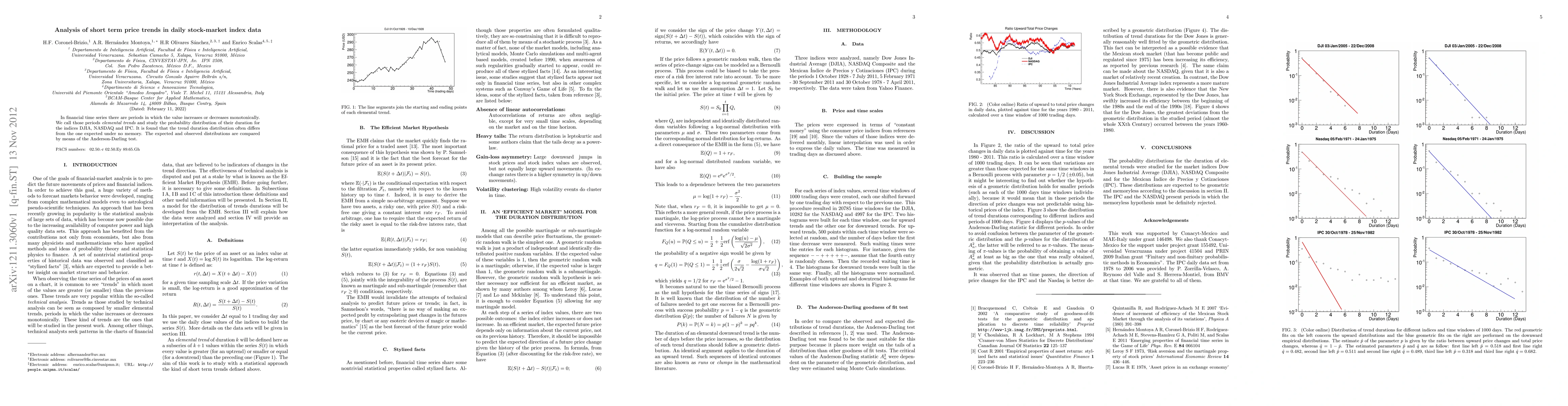

In financial time series there are periods in which the value increases or decreases monotonically. We call those periods elemental trends and study the probability distribution of their duration for the indices DJIA, NASDAQ and IPC. It is found that the trend duration distribution often differs from the one expected under no memory. The expected and observed distributions are compared by means of the Anderson-Darling test.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative Study of Long Short-Term Memory (LSTM) and Quantum Long Short-Term Memory (QLSTM): Prediction of Stock Market Movement

Tariq Mahmood, Ibtasam Ahmad, Malik Muhammad Zeeshan Ansar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)