Summary

In this paper we show that the optimal exercise boundary / free boundary of the American put option pricing problem for jump diffusions is continuously differentiable (except at the maturity). This differentiability result has been established by Yang et al. (European Journal of Applied Mathematics, 17(1):95-127, 2006) in the case where the condition $r\geq q+ \lambda \int_{\R_+} (e^z-1) \nu(dz)$ is satisfied. We extend the result to the case where the condition fails using a unified approach that treats both cases simultaneously. We also show that the boundary is infinitely differentiable under a regularity assumption on the jump distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

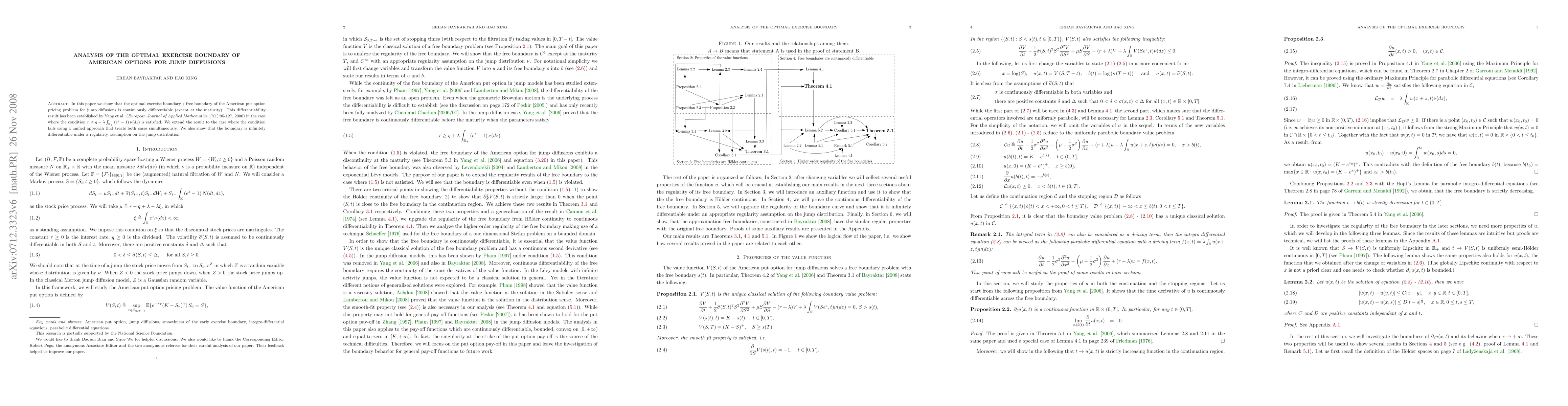

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)