Summary

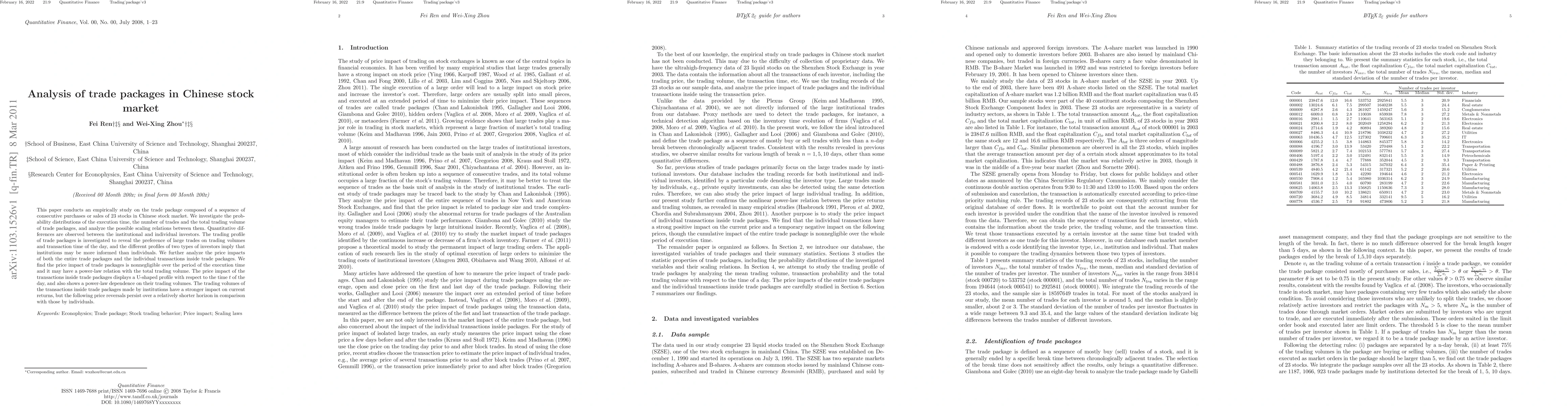

This paper conducts an empirically study on the trade package composed of a sequence of consecutive purchases or sales of 23 stocks in Chinese stock market. We investigate the probability distributions of the execution time, the number of trades and the total trading volume of trade packages, and analyze the possible scaling relations between them. Quantitative differences are observed between the institutional and individual investors. The trading profile of trade packages is investigated to reveal the preference of large trades on trading volumes and transaction time of the day, and the different profiles of two types of investors imply that institutions may be more informed than individuals. We further analyze the price impacts of both the entire trade packages and the individual transactions inside trade packages. We find the price impact of trade packages is nonnegligible over the period of the execution time and it may have a power-law relation with the total trading volume. The price impact of the transactions inside trade packages displays a U-shaped profile with respect to the time $t$ of the day, and also shows a power-law dependence on their trading volumes. The trading volumes of the transactions inside trade packages made by institutions have a stronger impact on current returns, but the following price reversals persist over a relatively shorter horizon in comparison with those by individuals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Market Making in the Chinese Stock Market: A Stochastic Control and Scenario Analysis

Shuaiqiang Liu, Shiqi Gong, Danny D. Sun

The Predictability of Stock Price: Empirical Study onTick Data in Chinese Stock Market

Tian Lan, Xingyu Xu, Sihai Zhang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)