Authors

Summary

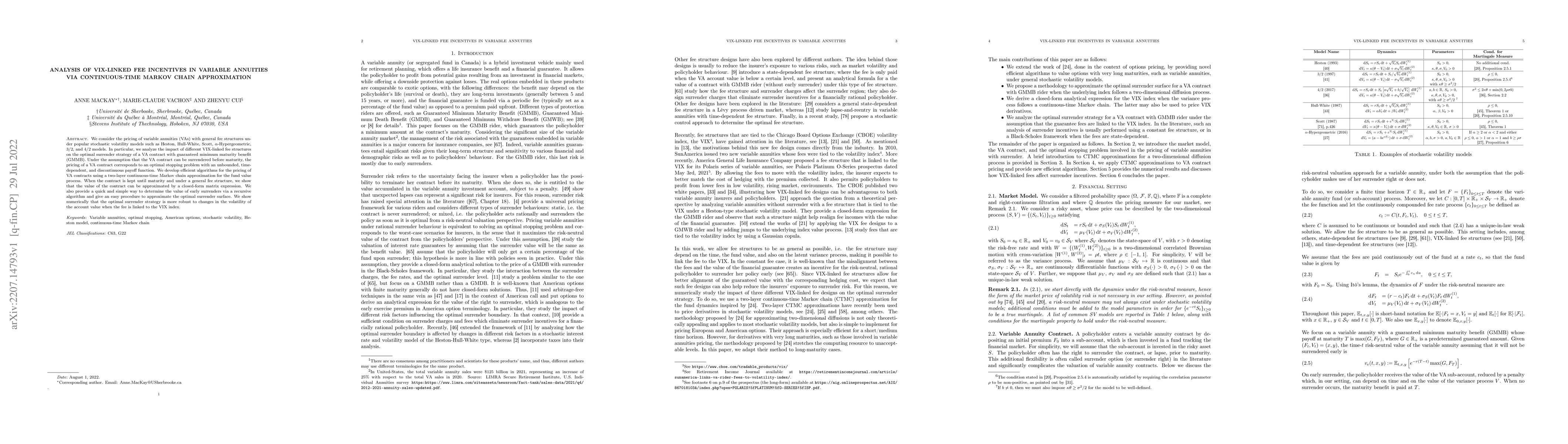

We consider the pricing of variable annuities (VAs) with general fee structures under popular stochastic volatility models such as Heston, Hull-White, Scott, $\alpha$-Hypergeometric, $3/2$, and $4/2$ models. In particular, we analyze the impact of different VIX-linked fee structures on the optimal surrender strategy of a VA contract with guaranteed minimum maturity benefit (GMMB). Under the assumption that the VA contract can be surrendered before maturity, the pricing of a VA contract corresponds to an optimal stopping problem with an unbounded, time-dependent, and discontinuous payoff function. We develop efficient algorithms for the pricing of VA contracts using a two-layer continuous-time Markov chain approximation for the fund value process. When the contract is kept until maturity and under a general fee structure, we show that the value of the contract can be approximated by a closed-form matrix expression. We also provide a quick and simple way to determine the value of early surrenders via a recursive algorithm and give an easy procedure to approximate the optimal surrender surface. We show numerically that the optimal surrender strategy is more robust to changes in the volatility of the account value when the fee is linked to the VIX index.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)