Summary

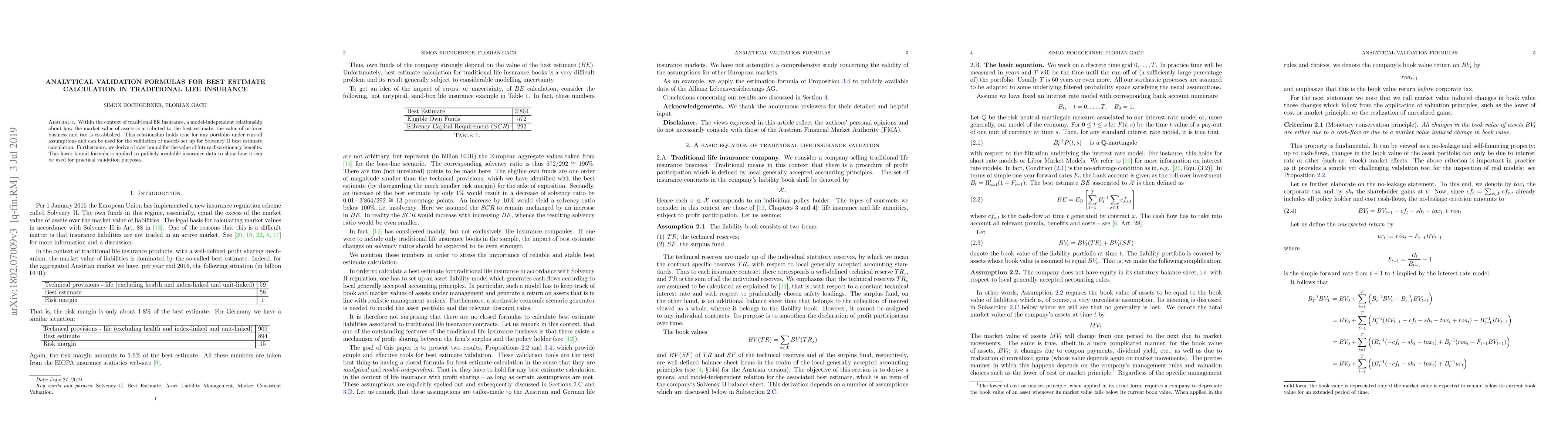

Within the context of traditional life insurance, a model-independent relationship about how the market value of assets is attributed to the best estimate, the value of in-force business and tax is established. This relationship holds true for any portfolio under run-off assumptions and can be used for the validation of models set up for Solvency~II best estimate calculation. Furthermore, we derive a lower bound for the value of future discretionary benefits. This lower bound formula is applied to publicly available insurance data to show how it can be used for practical validation purposes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEstimation of future discretionary benefits in traditional life insurance

Florian Gach, Simon Hochgerner

Automated Validation of Insurance Applications against Calculation Specifications

Shrawan Kumar, R Venkatesh, Advaita Datar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)