Authors

Summary

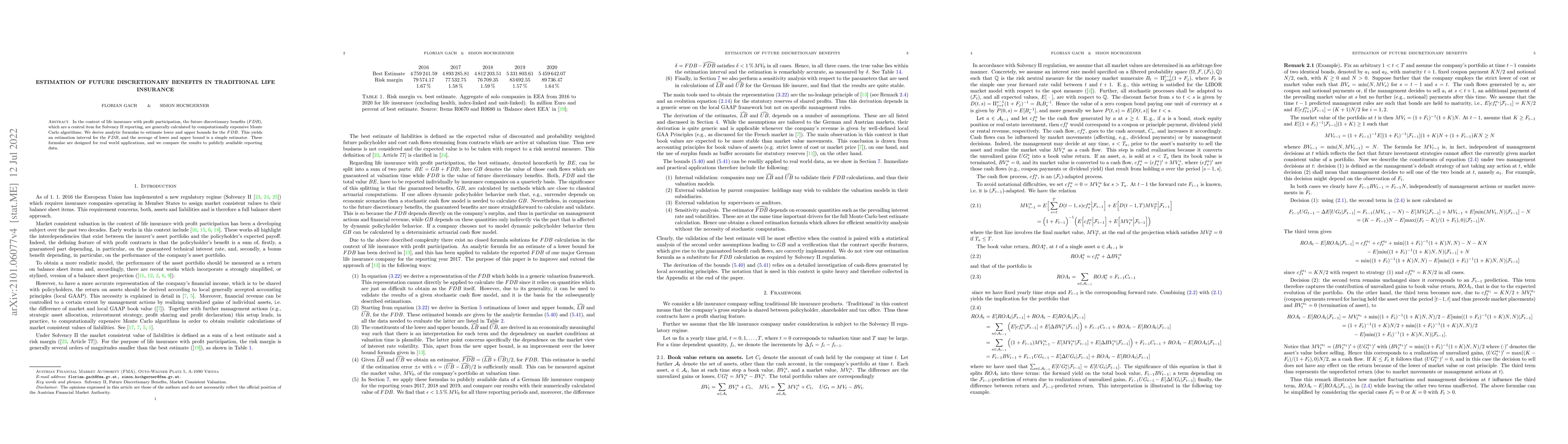

In the context of life insurance with profit participation, the future discretionary benefits ($FDB$), which are a central item for Solvency~II reporting, are generally calculated by computationally expensive Monte Carlo algorithms. We derive analytic formulas to estimate lower and upper bounds for the $FDB$. This yields an estimation interval for the $FDB$, and the average of lower and upper bound is a simple estimator. These formulae are designed for real world applications, and we compare the results to publicly available reporting data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComputation of bonus in multi-state life insurance

Christian Furrer, Jamaal Ahmad, Kristian Buchardt

| Title | Authors | Year | Actions |

|---|

Comments (0)