Simon Hochgerner

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

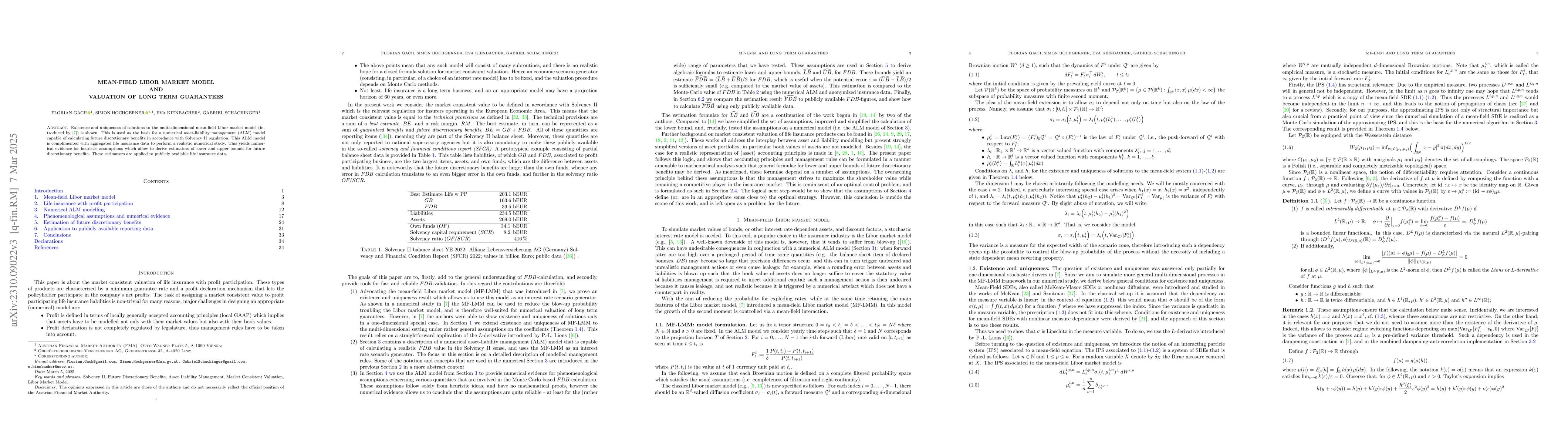

Mean-field Libor market model and valuation of long term guarantees

Existence and uniqueness of solutions to the multi-dimensional mean-field Libor market model (introduced by [7]) is shown. This is used as the basis for a numerical asset-liability management (ALM) ...

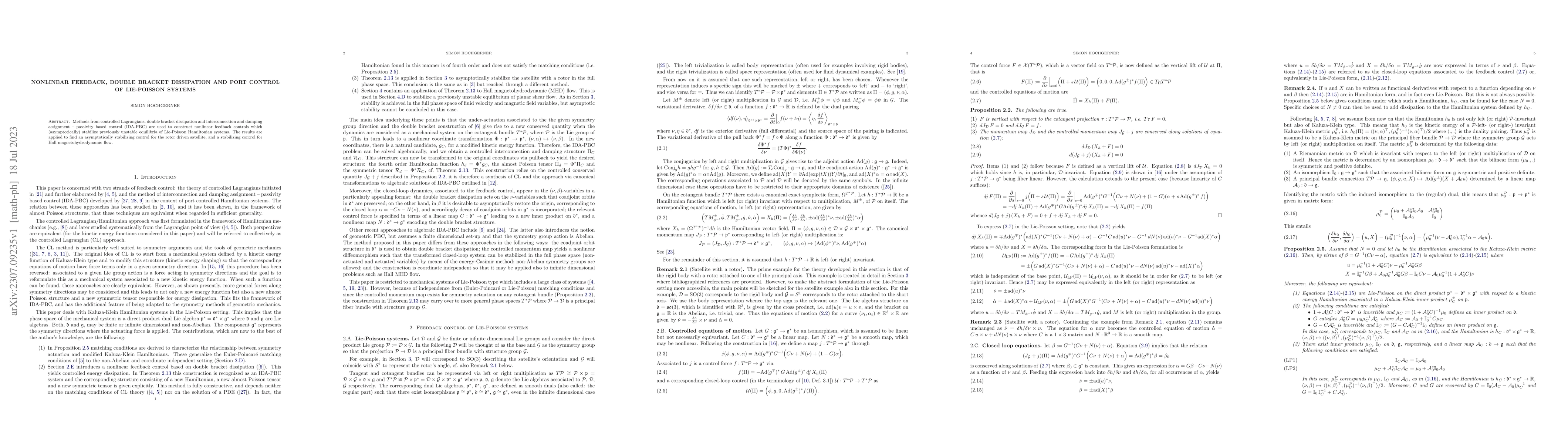

Nonlinear feedback, double bracket dissipation and port control of Lie-Poisson systems

Methods from controlled Lagrangians, double bracket dissipation and interconnection and damping assignment -- passivity based control (IDA-PBC) are used to construct nonlinear feedback controls whic...

A mean-field extension of the LIBOR market model

We introduce a mean-field extension of the LIBOR market model (LMM) which preserves the basic features of the original model. Among others, these features are the martingale property, a directly imp...

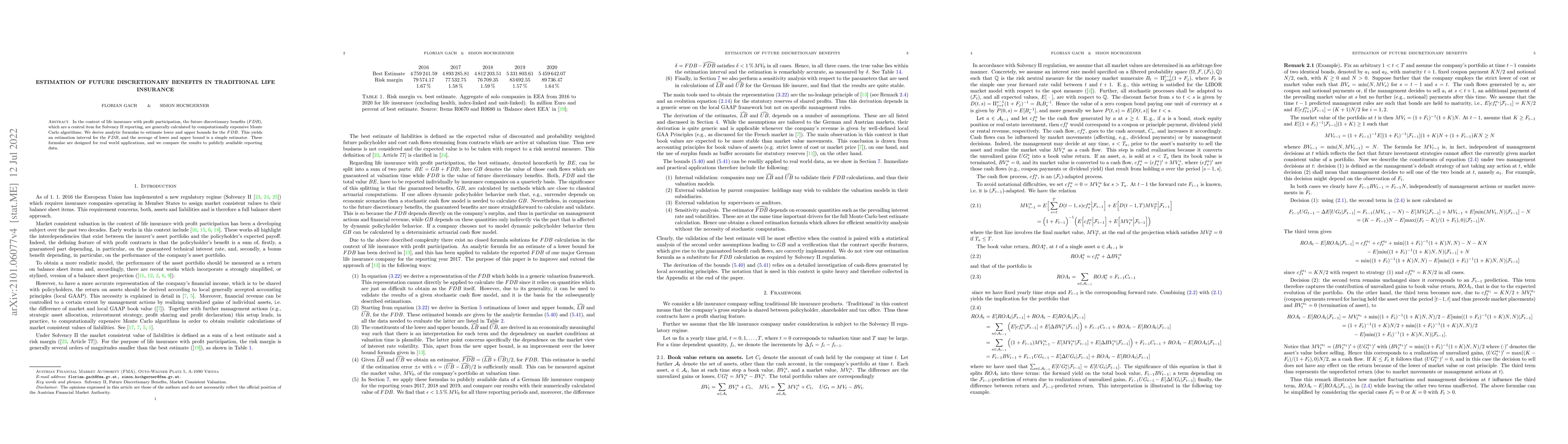

Estimation of future discretionary benefits in traditional life insurance

In the context of life insurance with profit participation, the future discretionary benefits ($FDB$), which are a central item for Solvency~II reporting, are generally calculated by computationally...

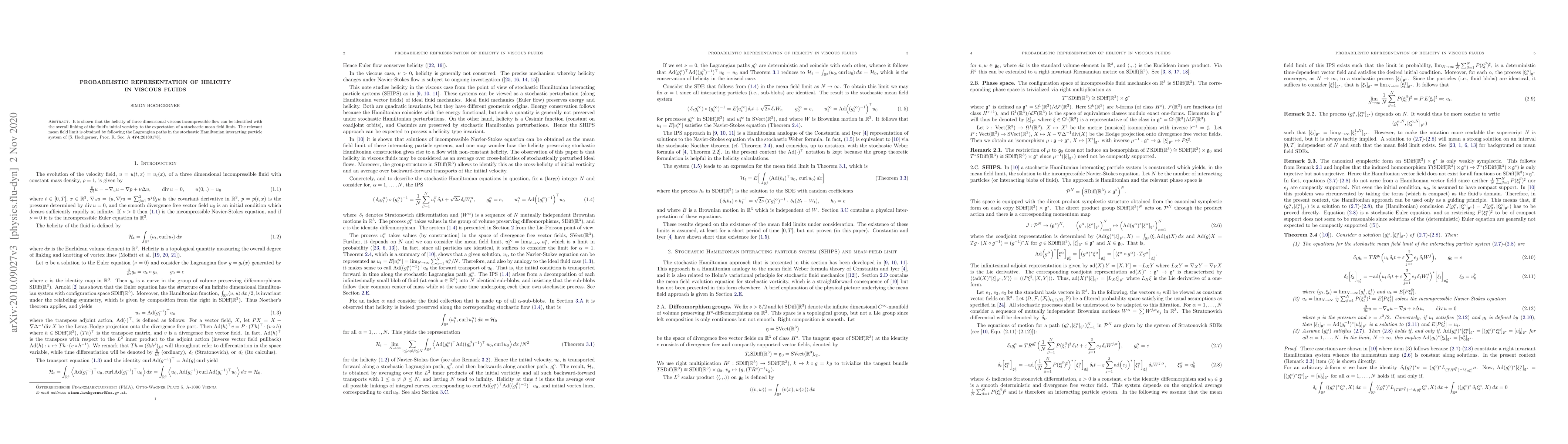

Probabilistic representation of helicity in viscous fluids

It is shown that the helicity of three dimensional viscous incompressible flow can be identified with the overall linking of the fluid's initial vorticity to the expectation of a stochastic mean fie...