Summary

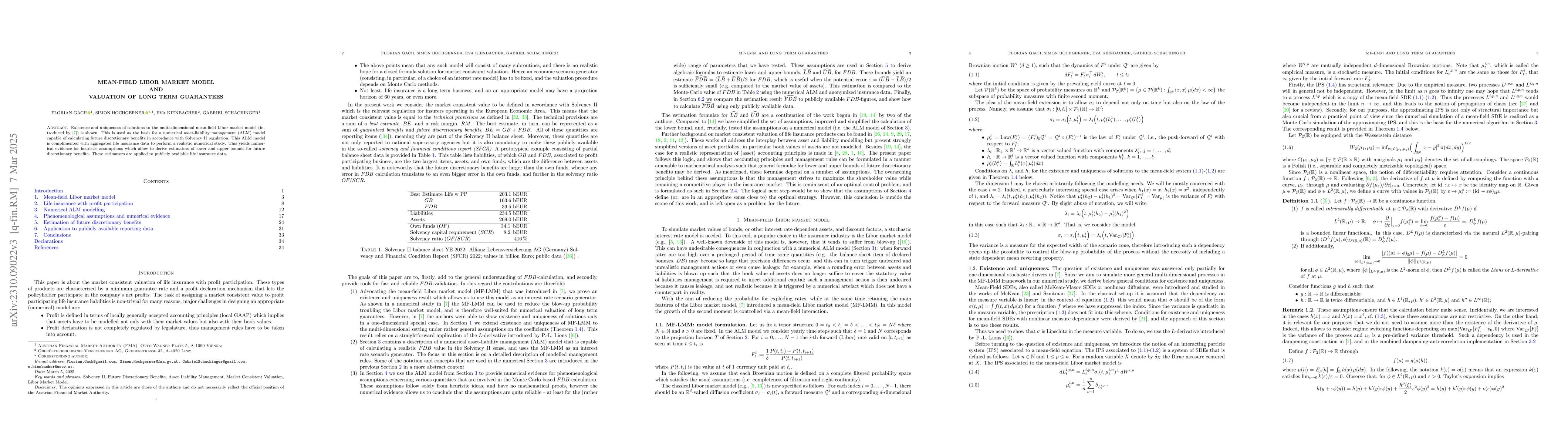

Existence and uniqueness of solutions to the multi-dimensional mean-field Libor market model (introduced by [7]) is shown. This is used as the basis for a numerical asset-liability management (ALM) model capable of calculating future discretionary benefits in accordance with Solvency~II regulation. This ALM model is complimented with aggregated life insurance data to perform a realistic numerical study. This yields numerical evidence for heuristic assumptions which allow to derive estimators of lower and upper bounds for future discretionary benefits. These estimators are applied to publicly available life insurance data.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA mean-field extension of the LIBOR market model

Sascha Desmettre, Simon Hochgerner, Stefan Thonhauser et al.

The Mean Field Market Model Revisited

Manuel Hasenbichler, Wolfgang Müller, Stefan Thonhauser

No citations found for this paper.

Comments (0)