Authors

Summary

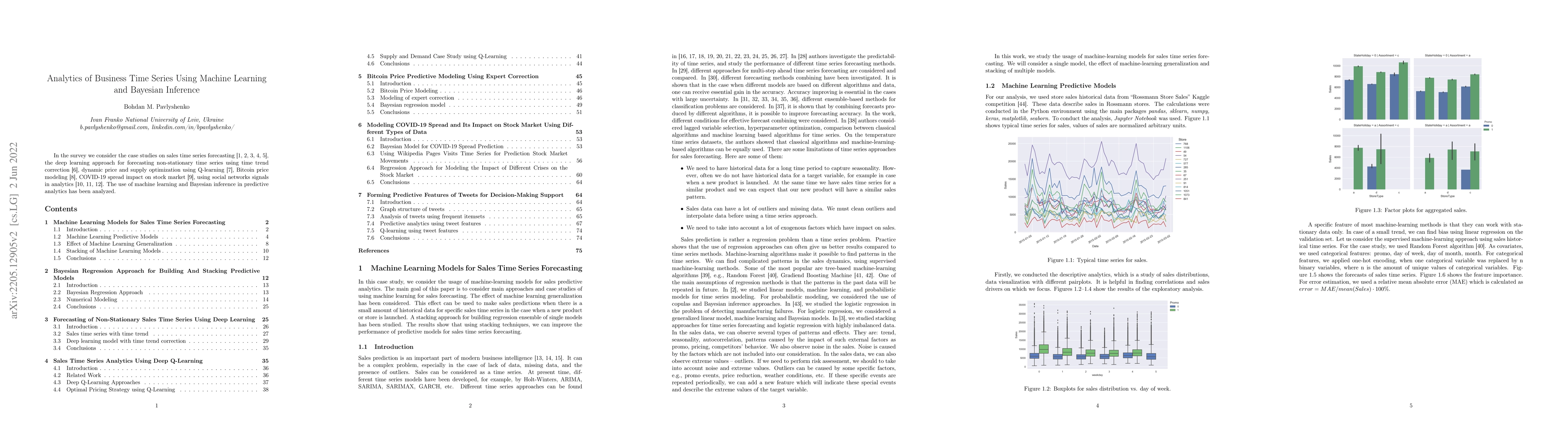

In the survey we consider the case studies on sales time series forecasting, the deep learning approach for forecasting non-stationary time series using time trend correction, dynamic price and supply optimization using Q-learning, Bitcoin price modeling, COVID-19 spread impact on stock market, using social networks signals in analytics. The use of machine learning and Bayesian inference in predictive analytics has been analyzed.

AI Key Findings

Generated Sep 02, 2025

Methodology

The research employs machine learning and Bayesian inference techniques for analyzing business time series data, including sales forecasting, Bitcoin price modeling, COVID-19 spread impact on the stock market, and using social network signals in analytics.

Key Results

- Deep learning approach with trend correction improved sales forecasting accuracy.

- Deep Q-learning models optimized pricing strategies and supply-demand problems.

- A Bayesian regression model with expert correction enhanced Bitcoin price prediction.

- Logistic curve model with Bayesian regression effectively predicted COVID-19 spread.

- Wikipedia page visits time series data was used to predict stock market movements.

Significance

This research is significant as it demonstrates the application of advanced machine learning and Bayesian methods to various business analytics problems, providing improved accuracy and insights in forecasting and decision-making processes.

Technical Contribution

The paper presents a comprehensive analysis of using machine learning and Bayesian inference for various business time series problems, including novel approaches for sales forecasting, Bitcoin price modeling, and COVID-19 impact assessment.

Novelty

The work stands out by combining deep learning with Bayesian inference for time series analysis, introducing trend correction in deep learning for sales forecasting, and applying Q-learning to pricing and supply-demand optimization problems.

Limitations

- Reliance on historical data may introduce bias in predictive models.

- Complex models can be computationally intensive and require substantial data.

Future Work

- Explore integration with real-time data streams for more dynamic predictions.

- Investigate the application of these methods to additional business domains.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnabling Inter-organizational Analytics in Business Networks Through Meta Machine Learning

Niklas Kühl, Gerhard Satzger, Dominik Martin et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)