Authors

Summary

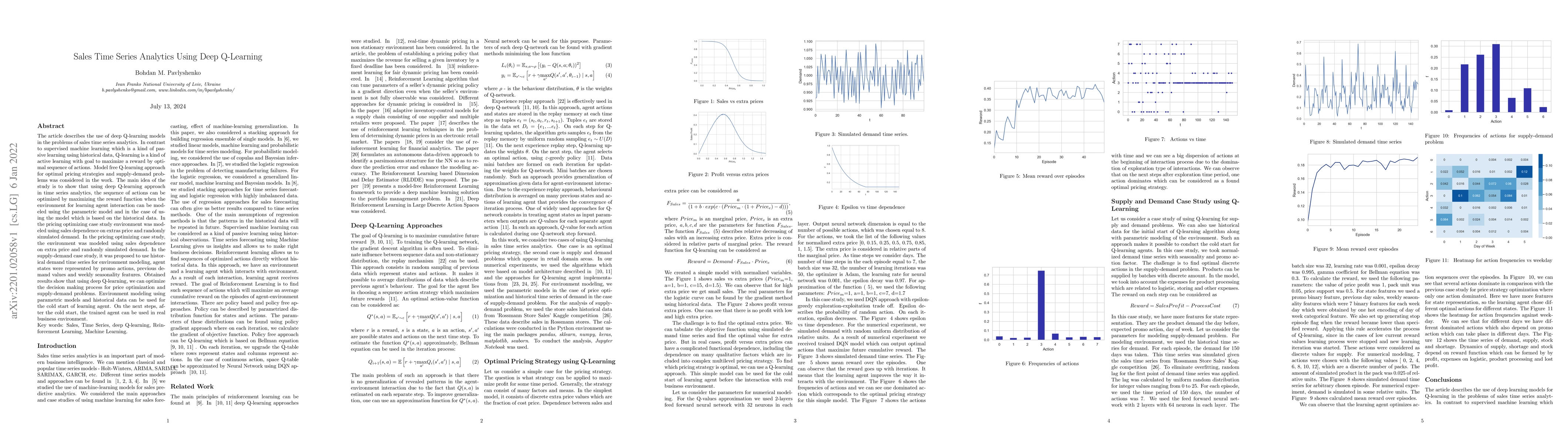

The article describes the use of deep Q-learning models in the problems of sales time series analytics. In contrast to supervised machine learning which is a kind of passive learning using historical data, Q-learning is a kind of active learning with goal to maximize a reward by optimal sequence of actions. Model free Q-learning approach for optimal pricing strategies and supply-demand problems was considered in the work. The main idea of the study is to show that using deep Q-learning approach in time series analytics, the sequence of actions can be optimized by maximizing the reward function when the environment for learning agent interaction can be modeled using the parametric model and in the case of using the model which is based on the historical data. In the pricing optimizing case study environment was modeled using sales dependence on extras price and randomly simulated demand. In the pricing optimizing case study, the environment was modeled using sales dependence on extra price and randomly simulated demand. In the supply-demand case study, it was proposed to use historical demand time series for environment modeling, agent states were represented by promo actions, previous demand values and weekly seasonality features. Obtained results show that using deep Q-learning, we can optimize the decision making process for price optimization and supply-demand problems. Environment modeling using parametric models and historical data can be used for the cold start of learning agent. On the next steps, after the cold start, the trained agent can be used in real business environment.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersForecasting of Non-Stationary Sales Time Series Using Deep Learning

Bohdan M. Pavlyshenko

Analytics of Business Time Series Using Machine Learning and Bayesian Inference

Bohdan M. Pavlyshenko

DeepVATS: Deep Visual Analytics for Time Series

Victor Rodriguez-Fernandez, David Camacho, Grzegorz J. Nalepa et al.

Time Series Prediction using Deep Learning Methods in Healthcare

Mohammad Amin Morid, Olivia R. Liu Sheng, Joseph Dunbar

| Title | Authors | Year | Actions |

|---|

Comments (0)