Authors

Summary

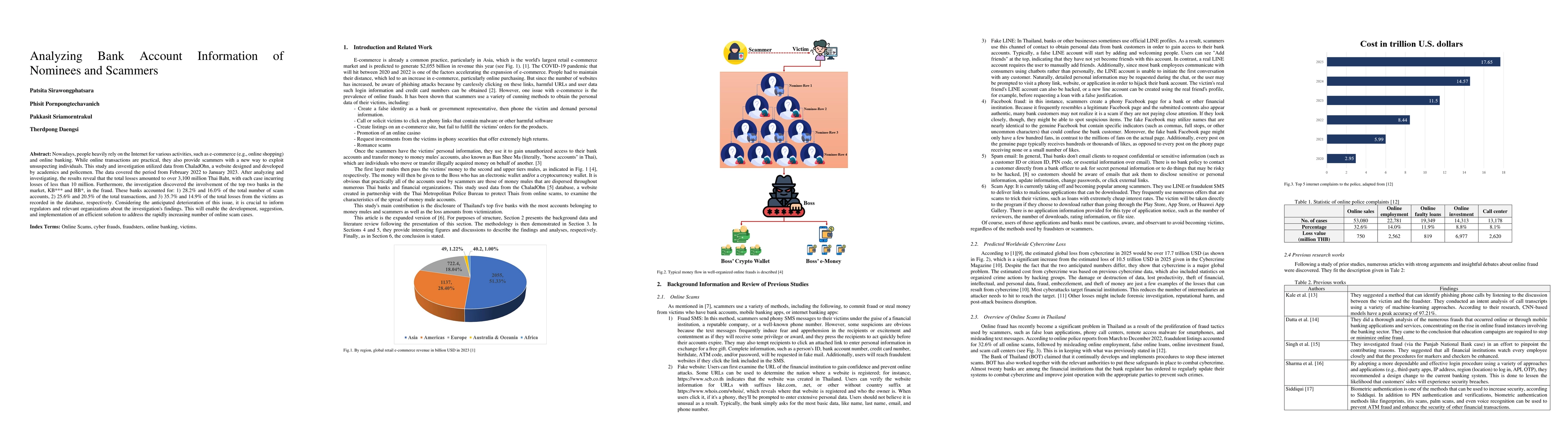

Nowadays, people heavily rely on the Internet for various activities, such as e-commerce (e.g., online shopping) and online banking. While online transactions are practical, they also provide scammers with a new way to exploit unsuspecting individuals. This study and investigation utilized data from ChaladOhn, a website designed and developed by academics and policemen. The data covered the period from February 2022 to January 2023. After analyzing and investigating, the results reveal that the total losses amounted to over 3,100 million Thai Baht, with each case incurring losses of less than 10 million. Furthermore, the investigation discovered the involvement of the top two banks in the market, KB*** and BB*, in the fraud. These banks accounted for: 1) 28.2% and 16.0% of the total number of scam accounts, 2) 25.6% and 20.5% of the total transactions, and 3) 35.7% and 14.9% of the total losses from the victims as recorded in the database, respectively. Considering the anticipated deterioration of this issue, it is crucial to inform regulators and relevant organizations about the investigation's findings. This will enable the development, suggestion, and implementation of an efficient solution to address the rapidly increasing number of online scam cases.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredential Control Balance: A Universal Blockchain Account Model Abstract From Bank to Bitcoin, Ethereum External Owned Account and Account Abstraction

Huifeng Jiao, Dr. Nathapon Udomlertsakul, Dr. Anukul Tamprasirt

Serial Scammers and Attack of the Clones: How Scammers Coordinate Multiple Rug Pulls on Decentralized Exchanges

Xiaodong Li, Emanuele Viterbo, Son Hoang Dau et al.

No citations found for this paper.

Comments (0)