Summary

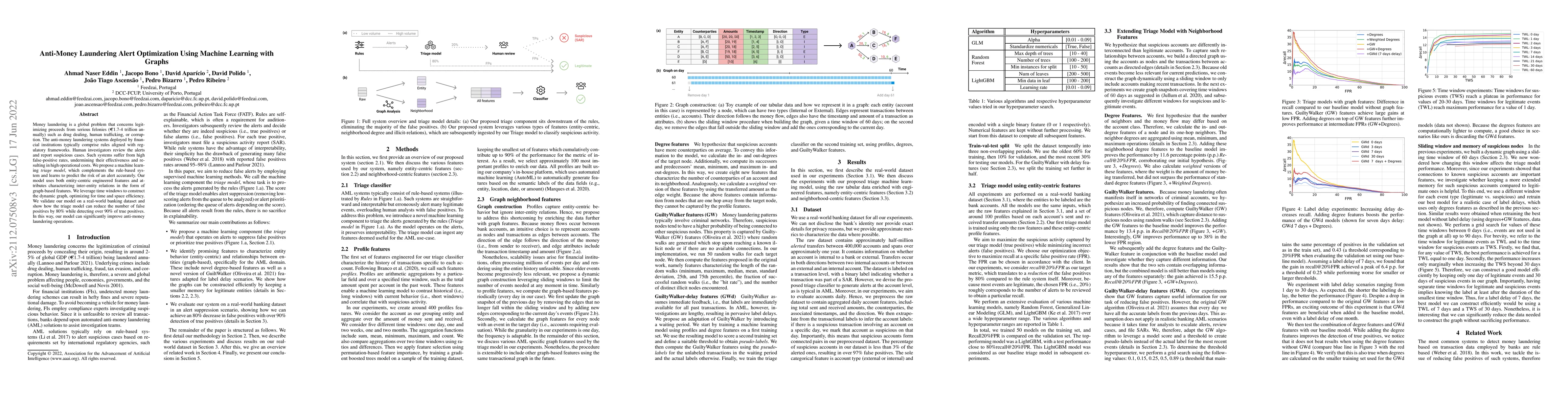

Money laundering is a global problem that concerns legitimizing proceeds from serious felonies (1.7-4 trillion euros annually) such as drug dealing, human trafficking, or corruption. The anti-money laundering systems deployed by financial institutions typically comprise rules aligned with regulatory frameworks. Human investigators review the alerts and report suspicious cases. Such systems suffer from high false-positive rates, undermining their effectiveness and resulting in high operational costs. We propose a machine learning triage model, which complements the rule-based system and learns to predict the risk of an alert accurately. Our model uses both entity-centric engineered features and attributes characterizing inter-entity relations in the form of graph-based features. We leverage time windows to construct the dynamic graph, optimizing for time and space efficiency. We validate our model on a real-world banking dataset and show how the triage model can reduce the number of false positives by 80% while detecting over 90% of true positives. In this way, our model can significantly improve anti-money laundering operations.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFighting Money Laundering with Statistics and Machine Learning

Rasmus Jensen, Alexandros Iosifidis

Privacy-Preserving Graph-Based Machine Learning with Fully Homomorphic Encryption for Collaborative Anti-Money Laundering

Anupam Chattopadhyay, Fabrianne Effendi

Enhancing Anti-Money Laundering Efforts with Network-Based Algorithms

Anthony Bonato, Juan Sebastian Chavez Palan, Adam Szava

Towards Collaborative Anti-Money Laundering Among Financial Institutions

Kui Ren, Xiang Yu, Jian Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)