Authors

Summary

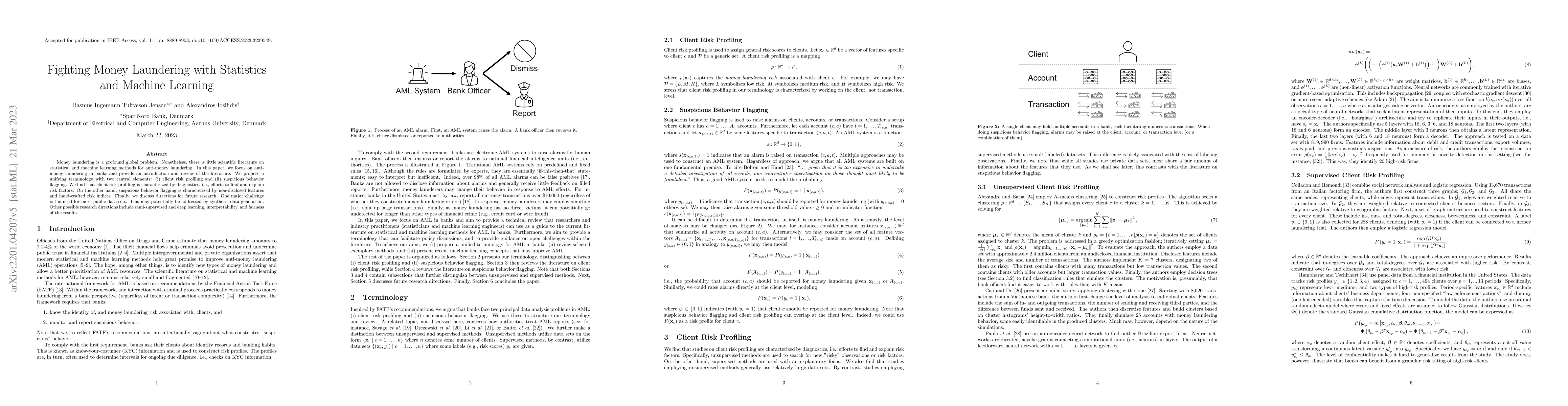

Money laundering is a profound global problem. Nonetheless, there is little scientific literature on statistical and machine learning methods for anti-money laundering. In this paper, we focus on anti-money laundering in banks and provide an introduction and review of the literature. We propose a unifying terminology with two central elements: (i) client risk profiling and (ii) suspicious behavior flagging. We find that client risk profiling is characterized by diagnostics, i.e., efforts to find and explain risk factors. On the other hand, suspicious behavior flagging is characterized by non-disclosed features and hand-crafted risk indices. Finally, we discuss directions for future research. One major challenge is the need for more public data sets. This may potentially be addressed by synthetic data generation. Other possible research directions include semi-supervised and deep learning, interpretability, and fairness of the results.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnti-Money Laundering Alert Optimization Using Machine Learning with Graphs

Ahmad Naser Eddin, Jacopo Bono, David Aparício et al.

Privacy-Preserving Graph-Based Machine Learning with Fully Homomorphic Encryption for Collaborative Anti-Money Laundering

Anupam Chattopadhyay, Fabrianne Effendi

Enhancing Anti-Money Laundering Efforts with Network-Based Algorithms

Anthony Bonato, Juan Sebastian Chavez Palan, Adam Szava

Representation learning with a transformer by contrastive learning for money laundering detection

Alain Celisse, Harold Guéneau, Pascal Delange

| Title | Authors | Year | Actions |

|---|

Comments (0)