Summary

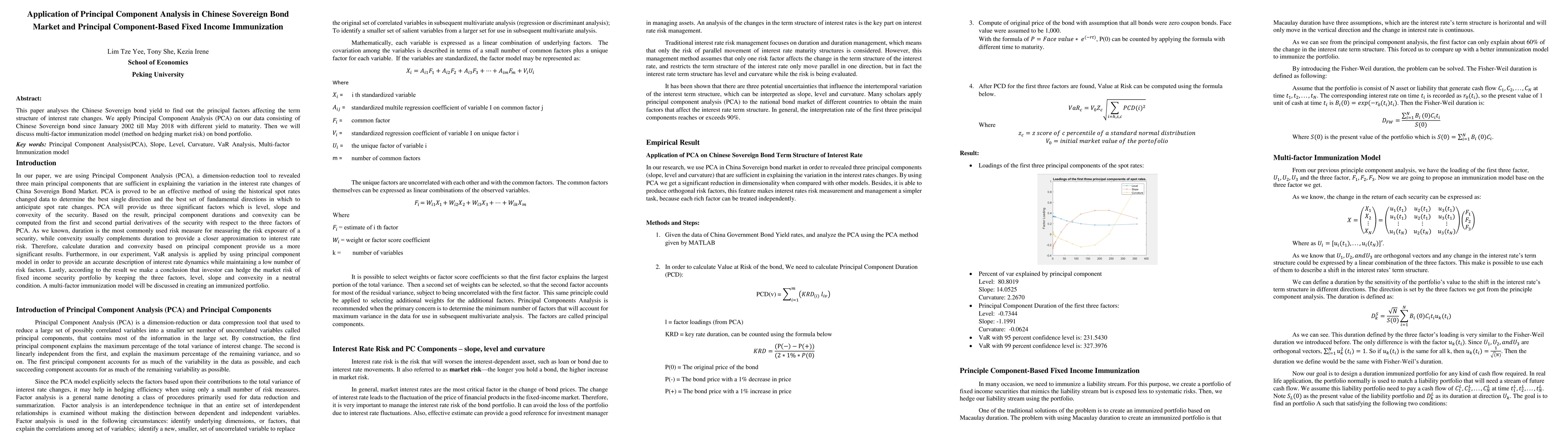

This paper analyses the Chinese Sovereign bond yield to find out the principal factors affecting the term structure of interest rate changes. We apply Principal Component Analysis (PCA) on our data consisting of the Chinese Sovereign bond from January 2002 till May 2018 with the different yield to maturity. Then we will discuss the multi-factor immunization model (method on hedging market risk) on a bond portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersExtrinsic Principal Component Analysis

Vic Patrangenaru, Ka Chun Wong, Robert L. Paige et al.

No citations found for this paper.

Comments (0)