Summary

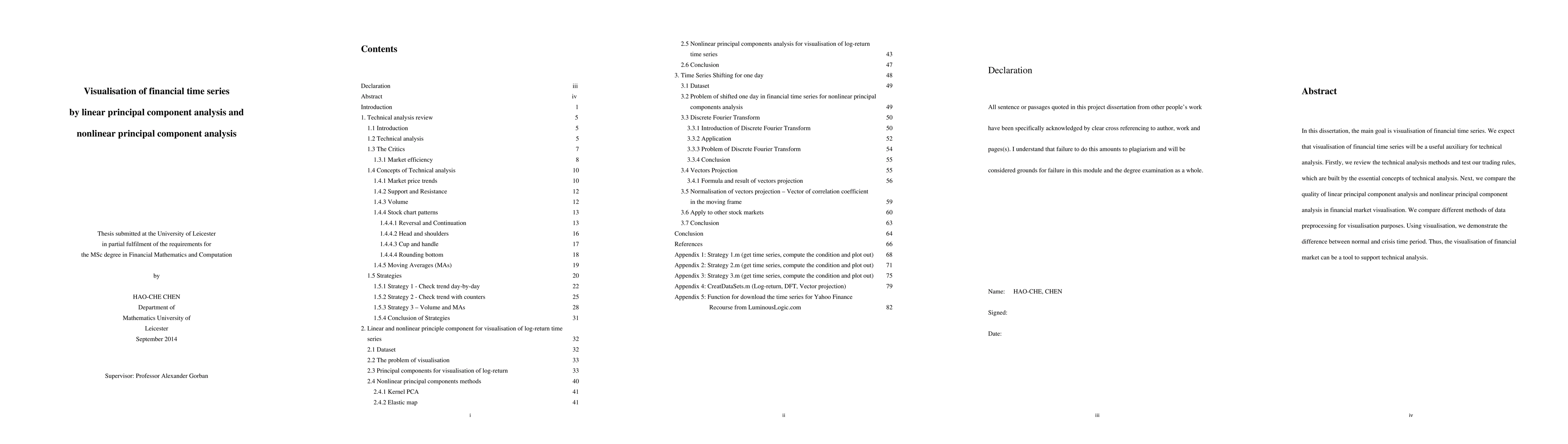

In this dissertation, the main goal is visualisation of financial time series. We expect that visualisation of financial time series will be a useful auxiliary for technical analysis. Firstly, we review the technical analysis methods and test our trading rules, which are built by the essential concepts of technical analysis. Next, we compare the quality of linear principal component analysis and nonlinear principal component analysis in financial market visualisation. We compare different methods of data preprocessing for visualisation purposes. Using visualisation, we demonstrate the difference between normal and crisis time period. Thus, the visualisation of financial market can be a tool to support technical analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAnomaly Detection on Financial Time Series by Principal Component Analysis and Neural Networks

Stéphane Crépey, Nisrine Madhar, Maud Thomas et al.

Localized Sparse Principal Component Analysis of Multivariate Time Series in Frequency Domain

Jamshid Namdari, Amita Manatunga, Fabio Ferrarelli et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)