Summary

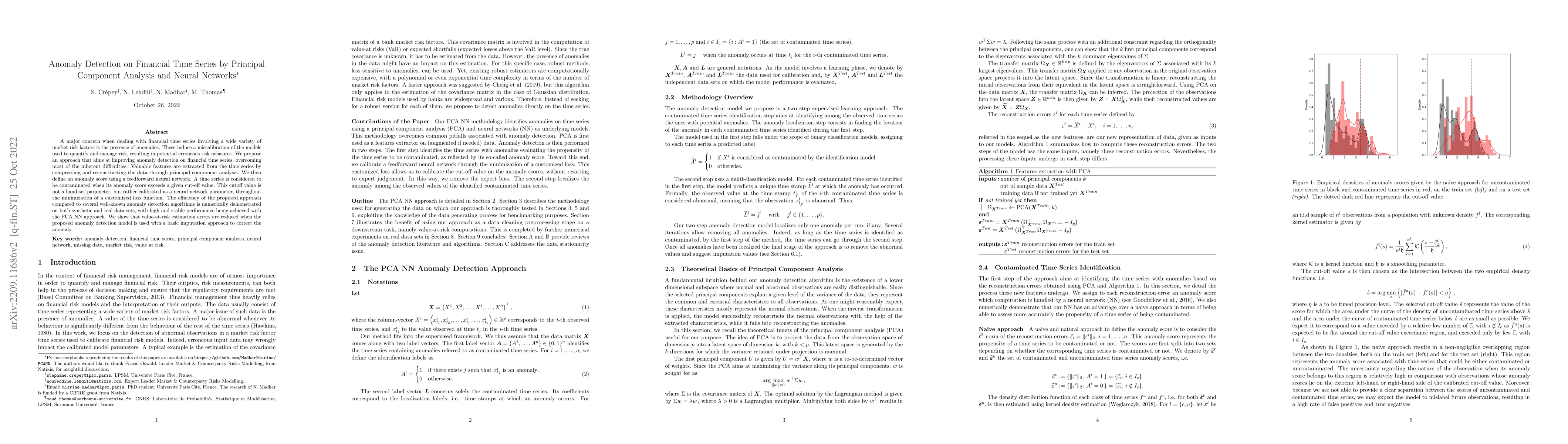

A major concern when dealing with financial time series involving a wide variety ofmarket risk factors is the presence of anomalies. These induce a miscalibration of the models used toquantify and manage risk, resulting in potential erroneous risk measures. We propose an approachthat aims to improve anomaly detection in financial time series, overcoming most of the inherentdifficulties. Valuable features are extracted from the time series by compressing and reconstructingthe data through principal component analysis. We then define an anomaly score using a feedforwardneural network. A time series is considered to be contaminated when its anomaly score exceeds agiven cutoff value. This cutoff value is not a hand-set parameter but rather is calibrated as a neuralnetwork parameter throughout the minimization of a customized loss function. The efficiency of theproposed approach compared to several well-known anomaly detection algorithms is numericallydemonstrated on both synthetic and real data sets, with high and stable performance being achievedwith the PCA NN approach. We show that value-at-risk estimation errors are reduced when theproposed anomaly detection model is used with a basic imputation approach to correct the anomaly.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDo Deep Neural Networks Contribute to Multivariate Time Series Anomaly Detection?

Maria A. Zuluaga, Pietro Michiardi, Frédéric Guyard et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)