Authors

Summary

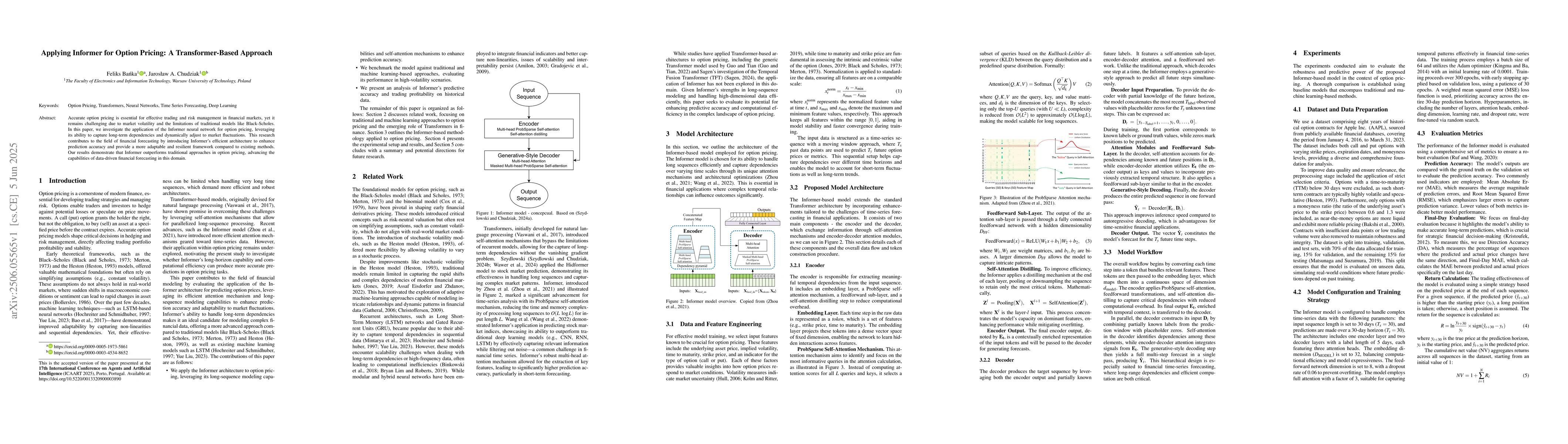

Accurate option pricing is essential for effective trading and risk management in financial markets, yet it remains challenging due to market volatility and the limitations of traditional models like Black-Scholes. In this paper, we investigate the application of the Informer neural network for option pricing, leveraging its ability to capture long-term dependencies and dynamically adjust to market fluctuations. This research contributes to the field of financial forecasting by introducing Informer's efficient architecture to enhance prediction accuracy and provide a more adaptable and resilient framework compared to existing methods. Our results demonstrate that Informer outperforms traditional approaches in option pricing, advancing the capabilities of data-driven financial forecasting in this domain.

AI Key Findings

Generated Jun 09, 2025

Methodology

The research applies the Informer neural network, known for capturing long-term dependencies and adapting to market fluctuations, to option pricing tasks, comparing its performance with traditional methods like Black-Scholes.

Key Results

- Informer outperforms traditional option pricing approaches in terms of prediction accuracy.

- Informer's efficient architecture provides a more adaptable and resilient framework for financial forecasting.

Significance

This research contributes to financial forecasting by introducing Informer, enhancing prediction accuracy and offering a more dynamic alternative to existing models, which is crucial for effective trading and risk management.

Technical Contribution

The application of the Informer neural network architecture to option pricing, demonstrating its superior performance over traditional models.

Novelty

This work introduces the use of Informer, a Transformer-based model, in financial forecasting for option pricing, offering a novel approach that addresses the limitations of existing methods.

Limitations

- The paper does not discuss the computational resources required for training the Informer model.

- Potential generalizability of Informer to other financial instruments beyond options is not explored.

Future Work

- Investigate the scalability of Informer for pricing various financial derivatives.

- Explore the integration of Informer with other machine learning techniques for improved performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApplying Reinforcement Learning to Option Pricing and Hedging

Zoran Stoiljkovic

A Hamiltonian Approach to Floating Barrier Option Pricing

Qi Chen, Chao Guo, Hong-tao Wang

| Title | Authors | Year | Actions |

|---|

Comments (0)