Summary

We design simple mechanisms to approximate the Gains from Trade (GFT) in two-sided markets with multiple unit-supply sellers and multiple unit-demand buyers. A classical impossibility result by Myerson and Satterthwaite showed that even with only one seller and one buyer, no Individually Rational (IR), Bayesian Incentive Compatible (BIC) and Budget-Balanced (BB) mechanism can achieve full GFT (trade whenever buyer's value is higher than the seller's cost). On the other hand, they proposed the "second-best" mechanism that maximizes the GFT subject to IR, BIC and BB constraints, which is unfortunately rather complex for even the single-seller single-buyer case. Our mechanism is simple, IR, BIC and BB, and achieves $\frac{1}{2}$ of the optimal GFT among all IR, BIC and BB mechanisms. Our result holds for arbitrary distributions of the buyers' and sellers' values and can accommodate any downward-closed feasibility constraints over the allocations. The analysis of our mechanism is facilitated by extending the Cai-Weinberg-Devanur duality framework to two-sided markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

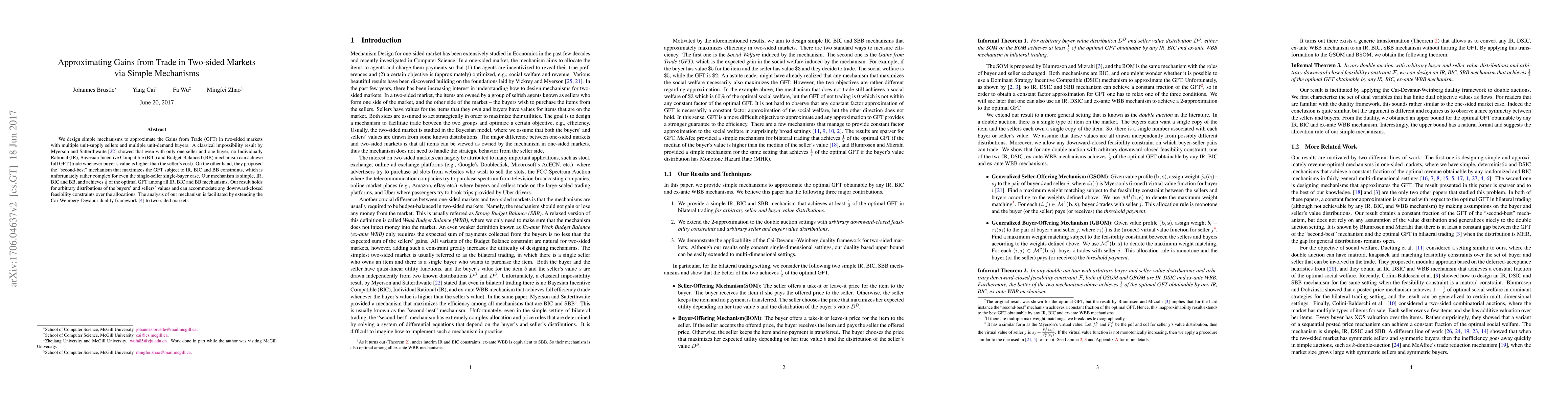

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLearning to Maximize Gains From Trade in Small Markets

Moshe Babaioff, Noam Nisan, Amitai Frey

On Multi-Dimensional Gains from Trade Maximization

Yang Cai, Mingfei Zhao, Kira Goldner et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)