Summary

We design algorithms for computing approximately revenue-maximizing {\em sequential posted-pricing mechanisms (SPM)} in $K$-unit auctions, in a standard Bayesian model. A seller has $K$ copies of an item to sell, and there are $n$ buyers, each interested in only one copy, who have some value for the item. The seller must post a price for each buyer, the buyers arrive in a sequence enforced by the seller, and a buyer buys the item if its value exceeds the price posted to it. The seller does not know the values of the buyers, but have Bayesian information about them. An SPM specifies the ordering of buyers and the posted prices, and may be {\em adaptive} or {\em non-adaptive} in its behavior. The goal is to design SPM in polynomial time to maximize expected revenue. We compare against the expected revenue of optimal SPM, and provide a polynomial time approximation scheme (PTAS) for both non-adaptive and adaptive SPMs. This is achieved by two algorithms: an efficient algorithm that gives a $(1-\frac{1}{\sqrt{2\pi K}})$-approximation (and hence a PTAS for sufficiently large $K$), and another that is a PTAS for constant $K$. The first algorithm yields a non-adaptive SPM that yields its approximation guarantees against an optimal adaptive SPM -- this implies that the {\em adaptivity gap} in SPMs vanishes as $K$ becomes larger.

AI Key Findings

Generated Sep 07, 2025

Methodology

The research uses a Bayesian model to design algorithms for computing approximately revenue-maximizing sequential posted-pricing mechanisms (SPM) in K-unit auctions.

Key Results

- Main finding: The proposed algorithms yield a $(1- rac{1}{ ext{sqrt}(2 ext{pi}K)})$-approximation of the optimal expected revenue for both non-adaptive and adaptive SPMs.

- The approximation scheme is achieved by two algorithms: an efficient algorithm that gives a $(1- rac{1}{ ext{sqrt}(2 ext{pi}K)})$-approximation for sufficiently large K, and another that is a PTAS for constant K.

- The first algorithm yields a non-adaptive SPM that yields its approximation guarantees against an optimal adaptive SPM -- implying the adaptivity gap in SPMs vanishes as K becomes larger.

Significance

This research is important because it provides a polynomial-time approximation scheme (PTAS) for both non-adaptive and adaptive sequential posted-pricing mechanisms (SPM) in multi-unit auctions, which can lead to significant revenue maximization.

Technical Contribution

The main technical contribution is the design and analysis of two approximation schemes for sequential posted-pricing mechanisms (SPM) in K-unit auctions, which achieve polynomial-time approximation guarantees.

Novelty

This work is novel because it provides a new approach to designing SPMs in multi-unit auctions, which can lead to significant revenue maximization and has the potential to improve the efficiency of online auction platforms.

Limitations

- The proposed algorithms assume that the buyers' values are drawn from a known distribution, which may not always be the case in real-world scenarios.

- The approximation scheme may not be suitable for very large K, as the approximation error increases with K.

Future Work

- Investigating the performance of the proposed algorithms on more complex auction models or with additional constraints.

- Developing more efficient algorithms for computing optimal SPMs in multi-unit auctions.

Paper Details

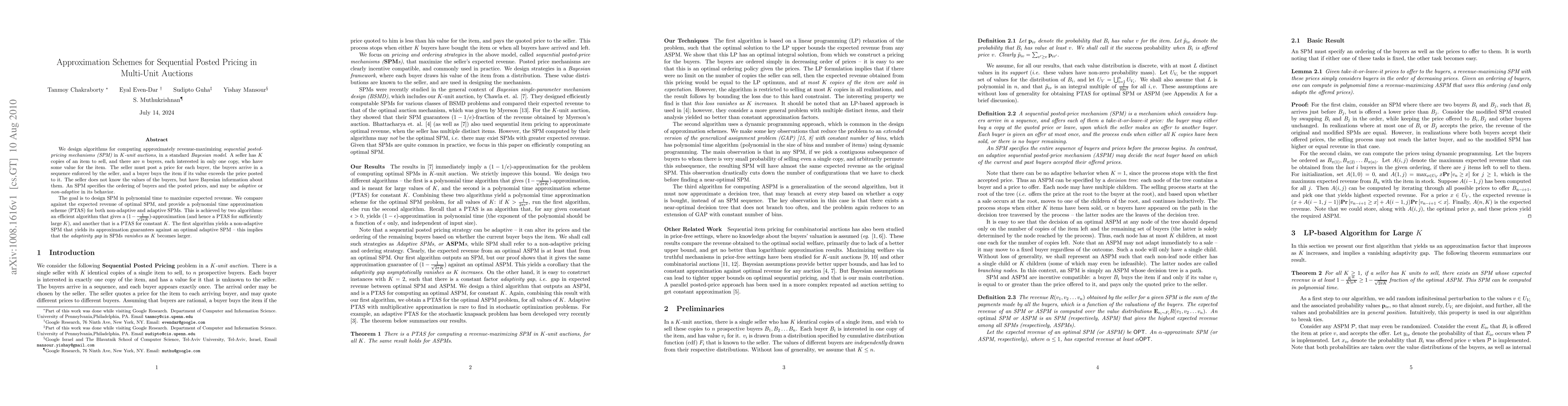

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)