Authors

Summary

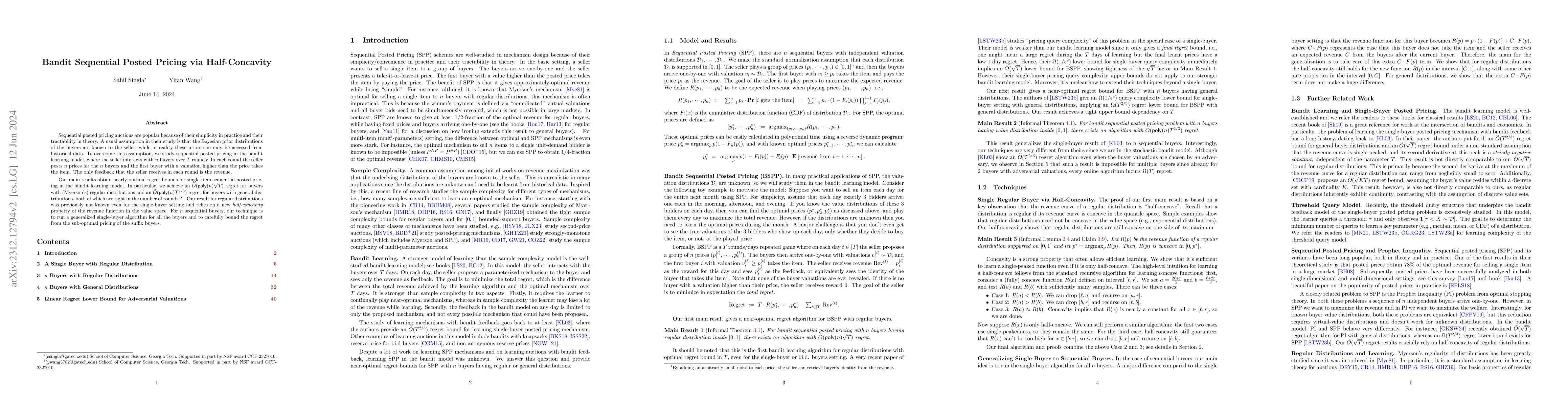

Sequential posted pricing auctions are popular because of their simplicity in practice and their tractability in theory. A usual assumption in their study is that the Bayesian prior distributions of the buyers are known to the seller, while in reality these priors can only be accessed from historical data. To overcome this assumption, we study sequential posted pricing in the bandit learning model, where the seller interacts with $n$ buyers over $T$ rounds: In each round the seller posts $n$ prices for the $n$ buyers and the first buyer with a valuation higher than the price takes the item. The only feedback that the seller receives in each round is the revenue. Our main results obtain nearly-optimal regret bounds for single-item sequential posted pricing in the bandit learning model. In particular, we achieve an $\tilde{O}(\mathsf{poly}(n)\sqrt{T})$ regret for buyers with (Myerson's) regular distributions and an $\tilde{O}(\mathsf{poly}(n)T^{{2}/{3}})$ regret for buyers with general distributions, both of which are tight in the number of rounds $T$. Our result for regular distributions was previously not known even for the single-buyer setting and relies on a new half-concavity property of the revenue function in the value space. For $n$ sequential buyers, our technique is to run a generalized single-buyer algorithm for all the buyers and to carefully bound the regret from the sub-optimal pricing of the suffix buyers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)