Summary

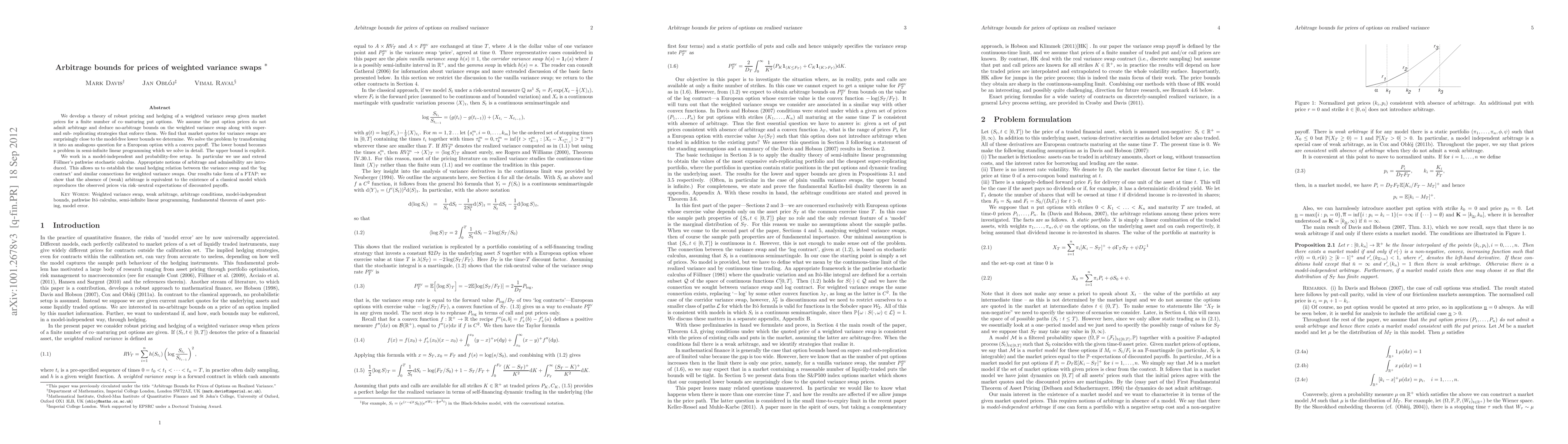

We develop robust pricing and hedging of a weighted variance swap when market prices for a finite number of co--maturing put options are given. We assume the given prices do not admit arbitrage and deduce no-arbitrage bounds on the weighted variance swap along with super- and sub- replicating strategies which enforce them. We find that market quotes for variance swaps are surprisingly close to the model-free lower bounds we determine. We solve the problem by transforming it into an analogous question for a European option with a convex payoff. The lower bound becomes a problem in semi-infinite linear programming which we solve in detail. The upper bound is explicit. We work in a model-independent and probability-free setup. In particular we use and extend F\"ollmer's pathwise stochastic calculus. Appropriate notions of arbitrage and admissibility are introduced. This allows us to establish the usual hedging relation between the variance swap and the 'log contract' and similar connections for weighted variance swaps. Our results take form of a FTAP: we show that the absence of (weak) arbitrage is equivalent to the existence of a classical model which reproduces the observed prices via risk-neutral expectations of discounted payoffs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)