Summary

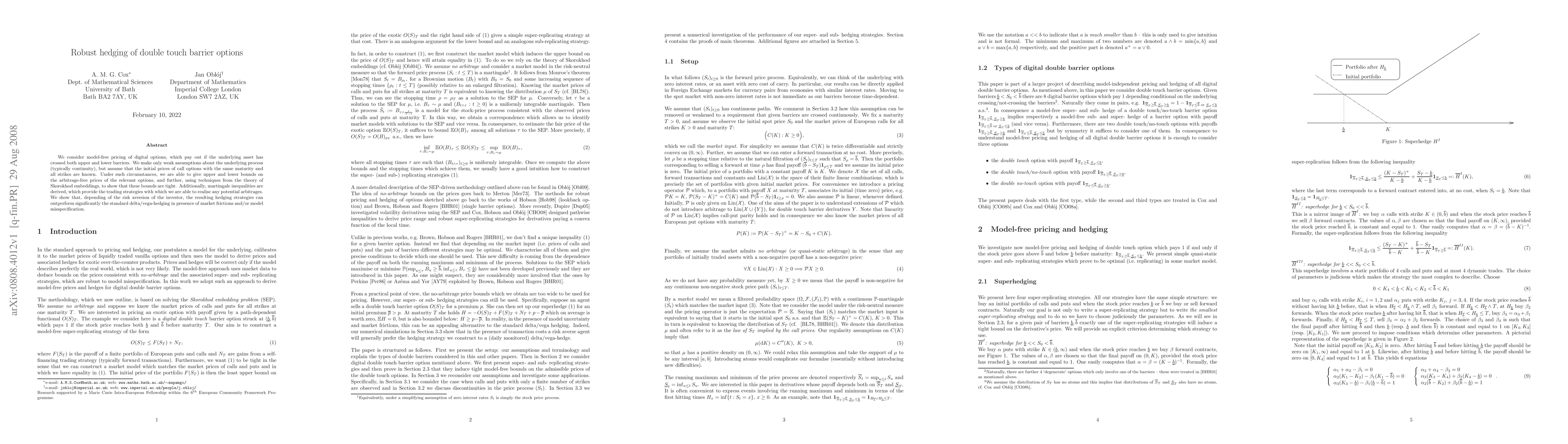

We consider model-free pricing of digital options, which pay out if the underlying asset has crossed both upper and lower barriers. We make only weak assumptions about the underlying process (typically continuity), but assume that the initial prices of call options with the same maturity and all strikes are known. Under such circumstances, we are able to give upper and lower bounds on the arbitrage-free prices of the relevant options, and further, using techniques from the theory of Skorokhod embeddings, to show that these bounds are tight. Additionally, martingale inequalities are derived, which provide the trading strategies with which we are able to realise any potential arbitrages. We show that, depending of the risk aversion of the investor, the resulting hedging strategies can outperform significantly the standard delta/vega-hedging in presence of market frictions and/or model misspecification.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)