Authors

Summary

We construct an aggregator for a family of Snell envelopes in a nondominated framework. We apply this construction to establish a robust hedging duality, along with the existence of a minimal hedging strategy, in a general semi-martingale setting for American-style options. Our results encompass continuous processes, or processes with jumps and non-vanishing diffusion. A key application is to financial market models, where uncertainty is quantified through the semi-martingale characteristics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

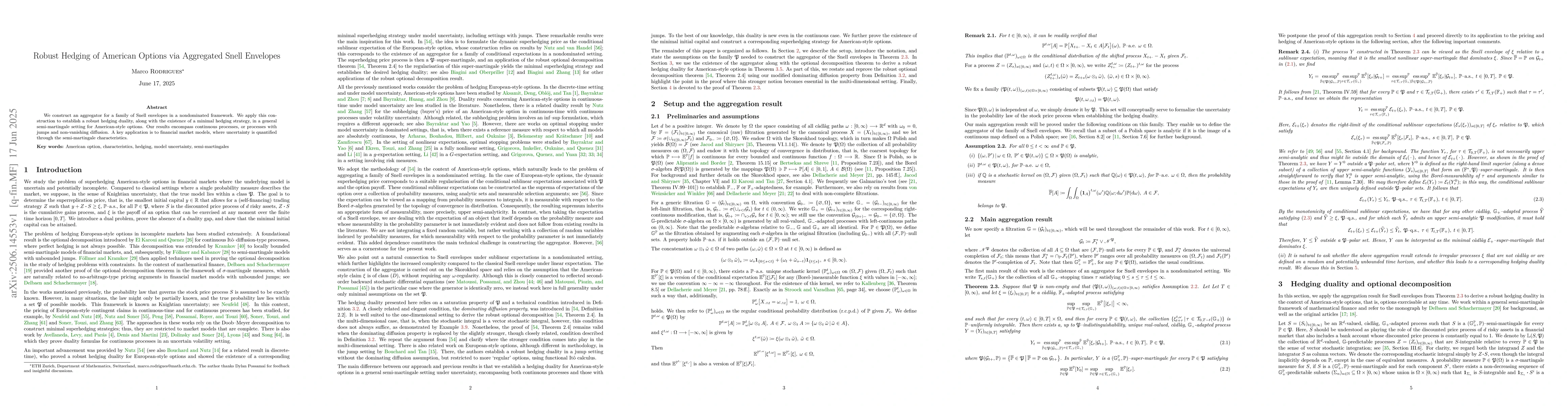

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)