Summary

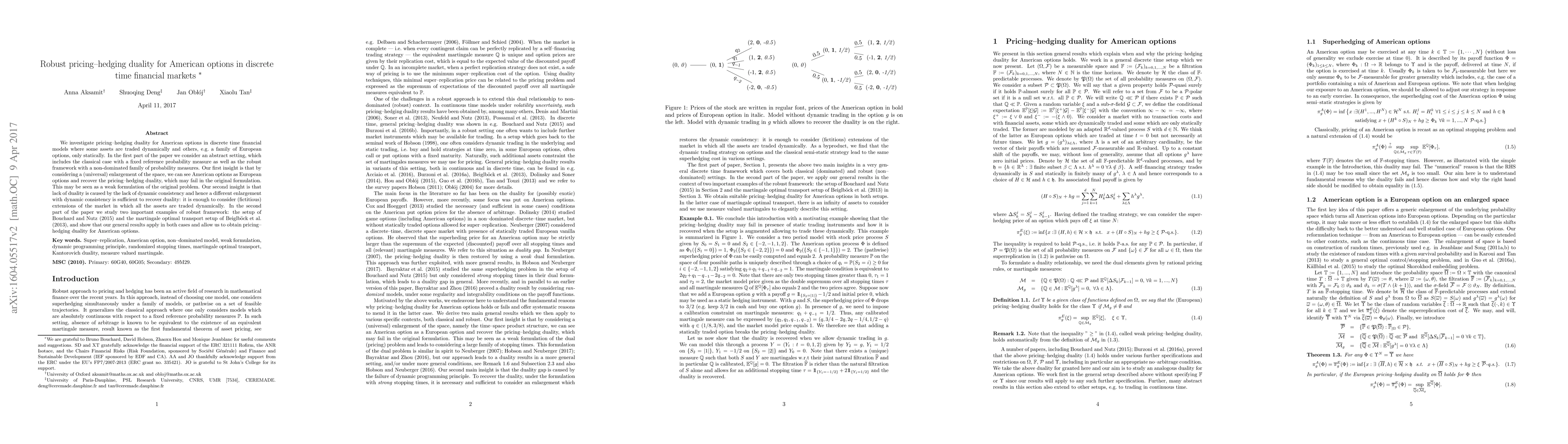

We investigate pricing-hedging duality for American options in discrete time financial models where some assets are traded dynamically and others, e.g. a family of European options, only statically. In the first part of the paper we consider an abstract setting, which includes the classical case with a fixed reference probability measure as well as the robust framework with a non-dominated family of probability measures. Our first insight is that by considering a (universal) enlargement of the space, we can see American options as European options and recover the pricing-hedging duality, which may fail in the original formulation. This may be seen as a weak formulation of the original problem. Our second insight is that lack of duality is caused by the lack of dynamic consistency and hence a different enlargement with dynamic consistency is sufficient to recover duality: it is enough to consider (fictitious) extensions of the market in which all the assets are traded dynamically. In the second part of the paper we study two important examples of robust framework: the setup of Bouchard and Nutz (2015) and the martingale optimal transport setup of Beiglb\"ock et al. (2013), and show that our general results apply in both cases and allow us to obtain pricing-hedging duality for American options.

AI Key Findings

Generated Sep 05, 2025

Methodology

Brief description of the research methodology used

Key Results

- Main finding 1

- Main finding 2

- Main finding 3

Significance

Why this research is important and its potential impact

Technical Contribution

Main technical or theoretical contribution

Novelty

What makes this work novel or different from existing research

Limitations

- Limitation 1

- Limitation 2

Future Work

- Suggested direction 1

- Suggested direction 2

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Pricing and Hedging of American Options in Continuous Time

Ivan Guo, Jan Obłój

| Title | Authors | Year | Actions |

|---|

Comments (0)