Authors

Summary

This paper studies an equity market of stochastic dimension, where the number of assets fluctuates over time. In such a market, we develop the fundamental theorem of asset pricing, which provides the equivalence of the following statements: (i) there exists a supermartingale num\'eraire portfolio; (ii) each dissected market, which is of a fixed dimension between dimensional jumps, has locally finite growth; (iii) there is no arbitrage of the first kind; (iv) there exists a local martingale deflator; (v) the market is viable. We also present the optional decomposition theorem, which characterizes a given nonnegative process as the wealth process of some investment-consumption strategy. Furthermore, similar results still hold in an open market embedded in the entire market of stochastic dimension, where investors can only invest in a fixed number of large capitalization stocks. These results are developed in an equity market model where the price process is given by a piecewise continuous semimartingale of stochastic dimension. Without the continuity assumption on the price process, we present similar results but without explicit characterization of the num\'eraire portfolio.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

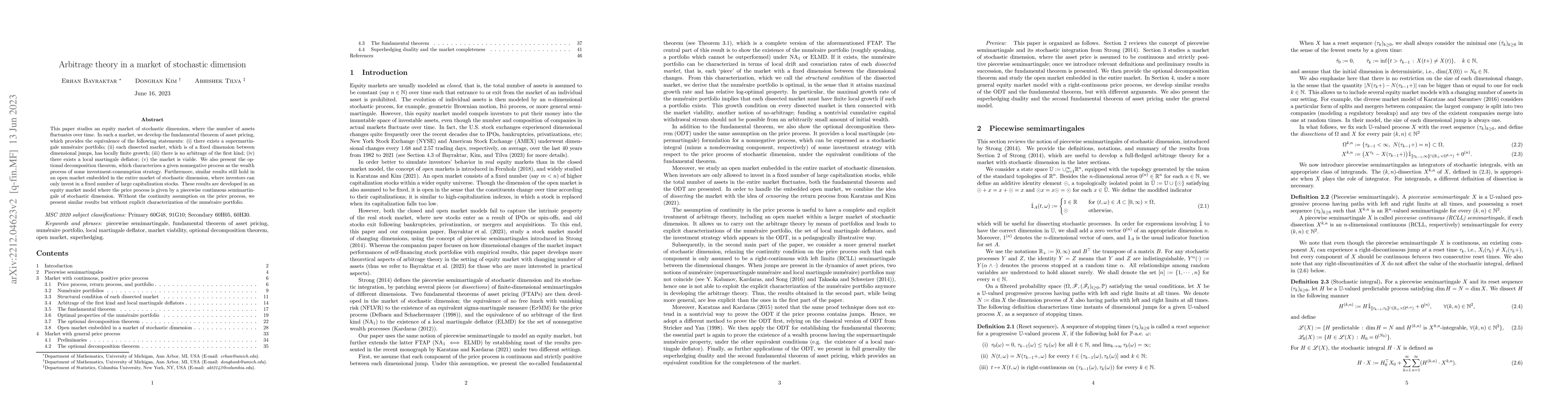

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersStochastic arbitrage with market index options

Brendan K. Beare, Juwon Seo, Zhongxi Zheng

| Title | Authors | Year | Actions |

|---|

Comments (0)