Summary

We call a given American option representable if there exists a European claim which dominates the American payoff at any time and such that the values of the two options coincide in the continuation region of the American option. This concept has interesting implications from a probabilistic, analytic, financial, and numeric point of view. Relying on methods from Jourdain and Martini (2001, 2002), Chrsitensen (2014) and convex duality, we make a first step towards verifying representability of American options.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

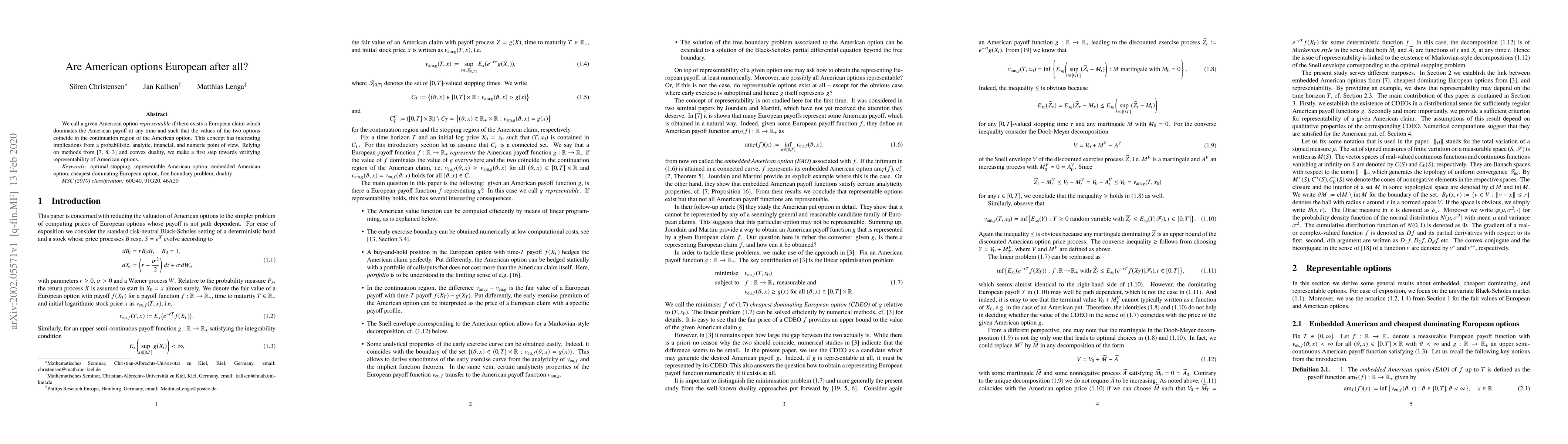

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersVulnerable European and American Options in a Market Model with Optional Hazard Process

Ruyi Liu, Marek Rutkowski, Libo Li

| Title | Authors | Year | Actions |

|---|

Comments (0)