Summary

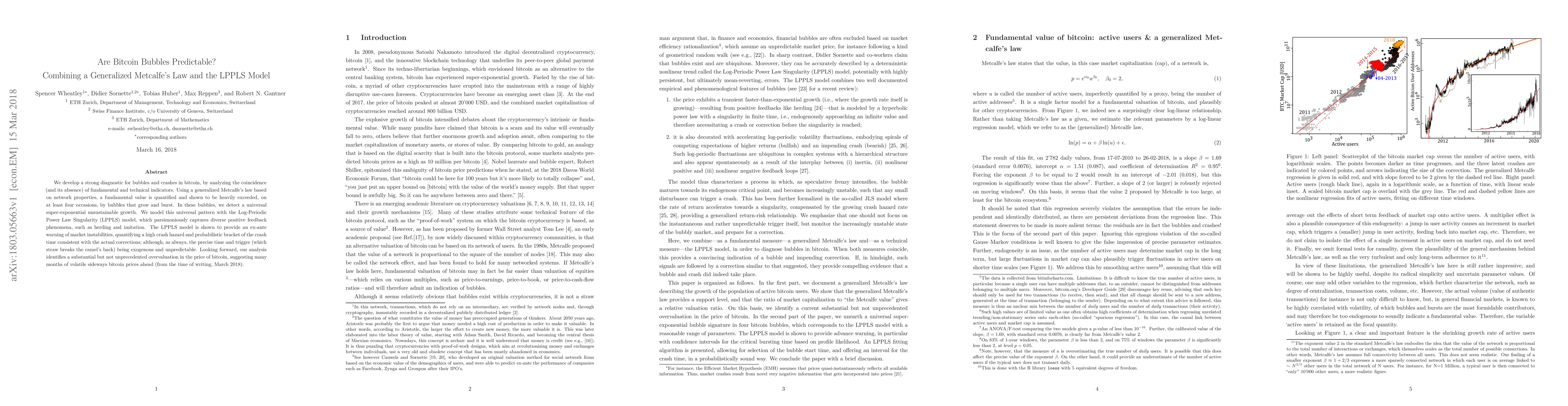

We develop a strong diagnostic for bubbles and crashes in bitcoin, by analyzing the coincidence (and its absence) of fundamental and technical indicators. Using a generalized Metcalfe's law based on network properties, a fundamental value is quantified and shown to be heavily exceeded, on at least four occasions, by bubbles that grow and burst. In these bubbles, we detect a universal super-exponential unsustainable growth. We model this universal pattern with the Log-Periodic Power Law Singularity (LPPLS) model, which parsimoniously captures diverse positive feedback phenomena, such as herding and imitation. The LPPLS model is shown to provide an ex-ante warning of market instabilities, quantifying a high crash hazard and probabilistic bracket of the crash time consistent with the actual corrections; although, as always, the precise time and trigger (which straw breaks the camel's back) being exogenous and unpredictable. Looking forward, our analysis identifies a substantial but not unprecedented overvaluation in the price of bitcoin, suggesting many months of volatile sideways bitcoin prices ahead (from the time of writing, March 2018).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)