Summary

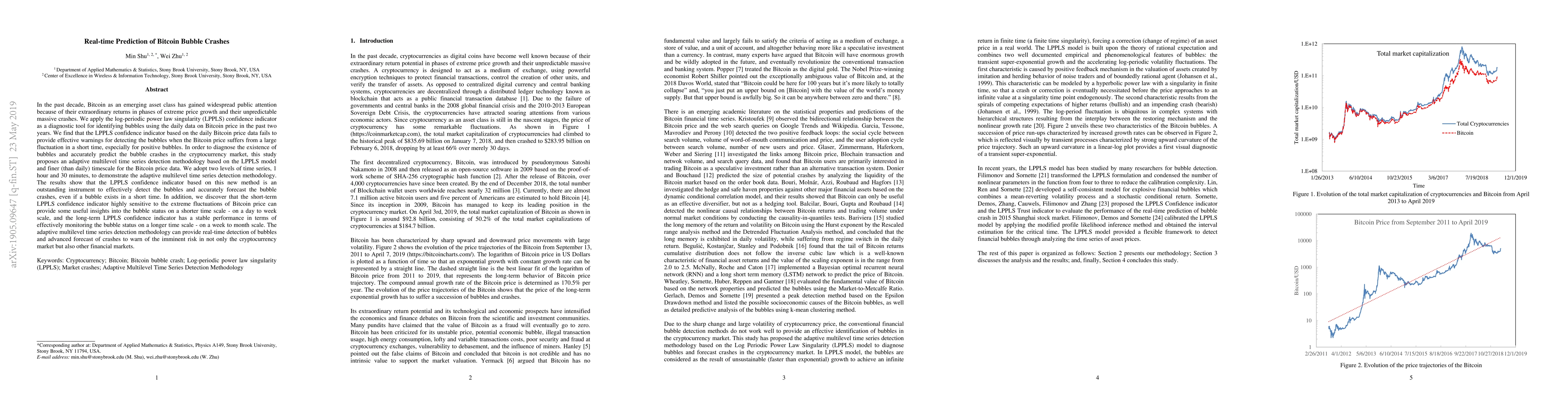

In the past decade, Bitcoin as an emerging asset class has gained widespread public attention because of their extraordinary returns in phases of extreme price growth and their unpredictable massive crashes. We apply the log-periodic power law singularity (LPPLS) confidence indicator as a diagnostic tool for identifying bubbles using the daily data on Bitcoin price in the past two years. We find that the LPPLS confidence indicator based on the daily Bitcoin price data fails to provide effective warnings for detecting the bubbles when the Bitcoin price suffers from a large fluctuation in a short time, especially for positive bubbles. In order to diagnose the existence of bubbles and accurately predict the bubble crashes in the cryptocurrency market, this study proposes an adaptive multilevel time series detection methodology based on the LPPLS model and finer (than daily) timescale for the Bitcoin price data. We adopt two levels of time series, 1 hour and 30 minutes, to demonstrate the adaptive multilevel time series detection methodology. The results show that the LPPLS confidence indicator based on this new method is an outstanding instrument to effectively detect the bubbles and accurately forecast the bubble crashes, even if a bubble exists in a short time. In addition, we discover that the short-term LPPLS confidence indicator highly sensitive to the extreme fluctuations of Bitcoin price can provide some useful insights into the bubble status on a shorter time scale - on a day to week scale, and the long-term LPPLS confidence indicator has a stable performance in terms of effectively monitoring the bubble status on a longer time scale - on a week to month scale. The adaptive multilevel time series detection methodology can provide real-time detection of bubbles and advanced forecast of crashes to warn of the imminent risk.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)