Authors

Summary

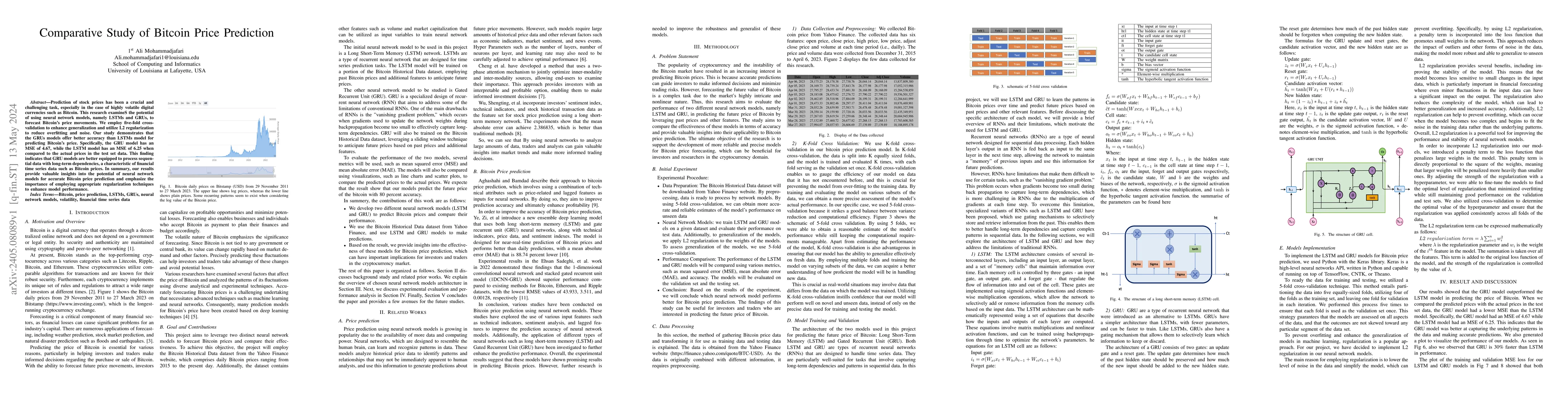

Prediction of stock prices has been a crucial and challenging task, especially in the case of highly volatile digital currencies such as Bitcoin. This research examineS the potential of using neural network models, namely LSTMs and GRUs, to forecast Bitcoin's price movements. We employ five-fold cross-validation to enhance generalization and utilize L2 regularization to reduce overfitting and noise. Our study demonstrates that the GRUs models offer better accuracy than LSTMs model for predicting Bitcoin's price. Specifically, the GRU model has an MSE of 4.67, while the LSTM model has an MSE of 6.25 when compared to the actual prices in the test set data. This finding indicates that GRU models are better equipped to process sequential data with long-term dependencies, a characteristic of financial time series data such as Bitcoin prices. In summary, our results provide valuable insights into the potential of neural network models for accurate Bitcoin price prediction and emphasize the importance of employing appropriate regularization techniques to enhance model performance.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCross Cryptocurrency Relationship Mining for Bitcoin Price Prediction

Qi Xuan, Jiajun Zhou, Shengbo Gong et al.

Improved Bitcoin Price Prediction based on COVID-19 data

Palina Niamkova, Rafael Moreira

| Title | Authors | Year | Actions |

|---|

Comments (0)