Authors

Summary

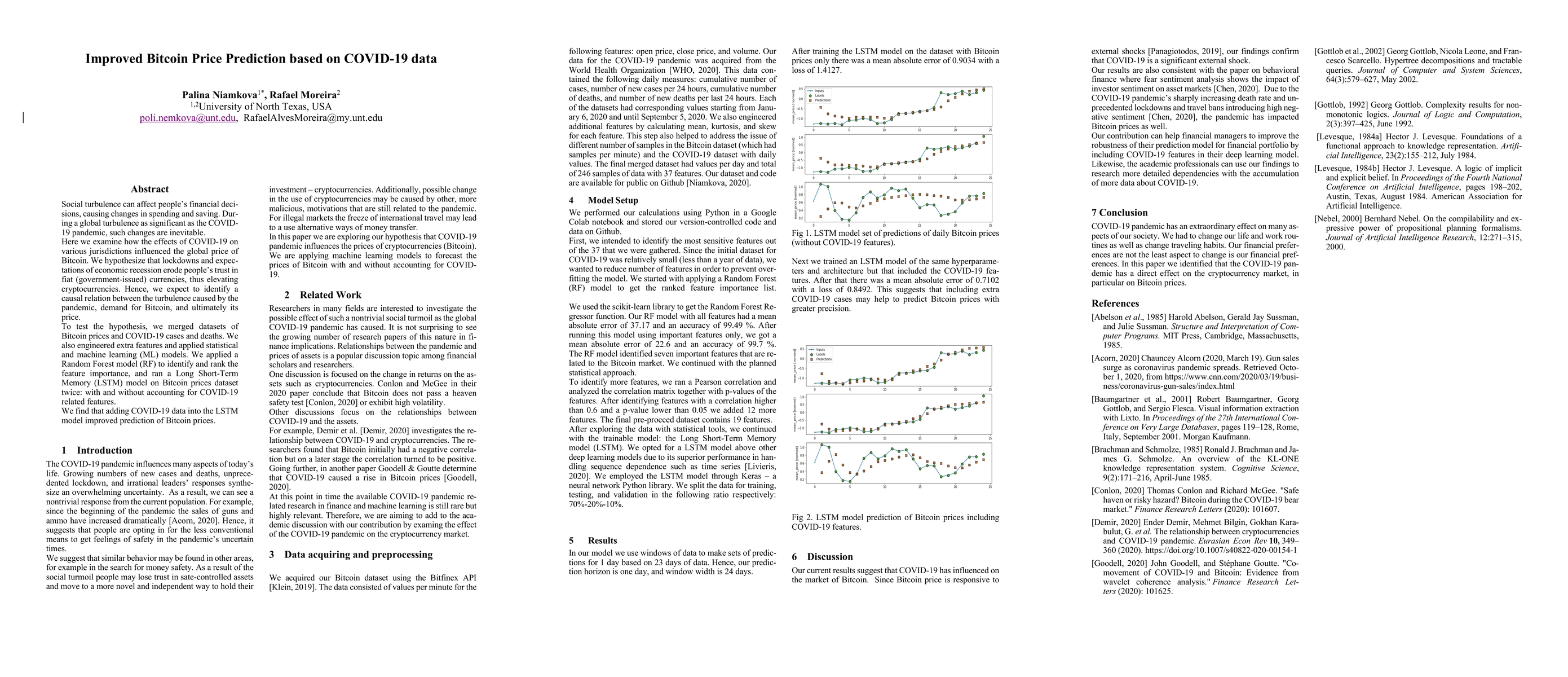

Social turbulence can affect people financial decisions, causing changes in spending and saving. During a global turbulence as significant as the COVID-19 pandemic, such changes are inevitable. Here we examine how the effects of COVID-19 on various jurisdictions influenced the global price of Bitcoin. We hypothesize that lock downs and expectations of economic recession erode people trust in fiat (government-issued) currencies, thus elevating cryptocurrencies. Hence, we expect to identify a causal relation between the turbulence caused by the pandemic, demand for Bitcoin, and ultimately its price. To test the hypothesis, we merged datasets of Bitcoin prices and COVID-19 cases and deaths. We also engineered extra features and applied statistical and machine learning (ML) models. We applied a Random Forest model (RF) to identify and rank the feature importance, and ran a Long Short-Term Memory (LSTM) model on Bitcoin prices data set twice: with and without accounting for COVID-19 related features. We find that adding COVID-19 data into the LSTM model improved prediction of Bitcoin prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)