Summary

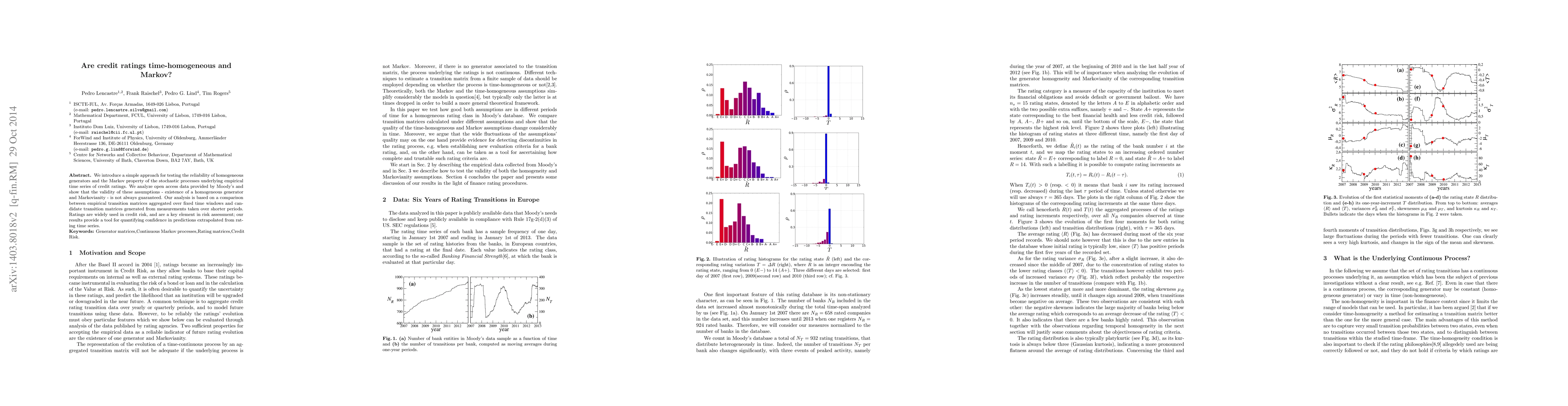

We introduce a simple approach for testing the reliability of homogeneous generators and the Markov property of the stochastic processes underlying empirical time series of credit ratings. We analyze open access data provided by Moody's and show that the validity of these assumptions - existence of a homogeneous generator and Markovianity - is not always guaranteed. Our analysis is based on a comparison between empirical transition matrices aggregated over fixed time windows and candidate transition matrices generated from measurements taken over shorter periods. Ratings are widely used in credit risk, and are a key element in risk assessment; our results provide a tool for quantifying confidence in predictions extrapolated from these time series.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCredit Ratings: Heterogeneous Effect on Capital Structure

Helmut Wasserbacher, Martin Spindler

A Markov approach to credit rating migration conditional on economic states

Michael Kalkbrener, Natalie Packham

| Title | Authors | Year | Actions |

|---|

Comments (0)