Summary

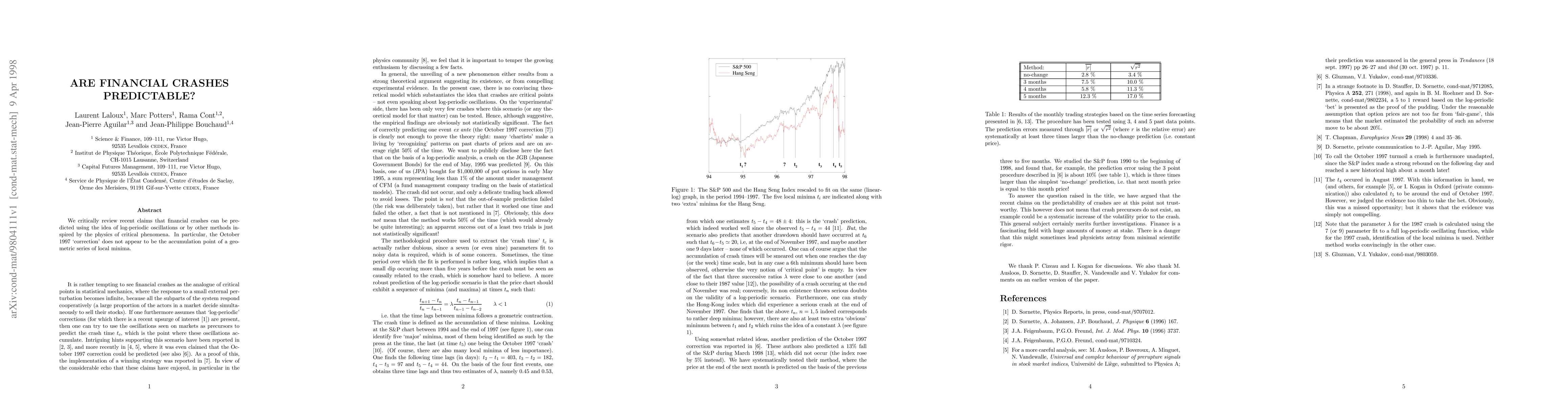

We critically review recent claims that financial crashes can be predicted using the idea of log-periodic oscillations or by other methods inspired by the physics of critical phenomena. In particular, the October 1997 `correction' does not appear to be the accumulation point of a geometric series of local minima.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)