Summary

A key problem in financial mathematics is the forecasting of financial crashes: if we perturb asset prices, will financial institutions fail on a massive scale? This was recently shown to be a computationally intractable (NP-hard) problem. Financial crashes are inherently difficult to predict, even for a regulator which has complete information about the financial system. In this paper we show how this problem can be handled by quantum annealers. More specifically, we map the equilibrium condition of a toy-model financial network to the ground-state problem of a spin-1/2 quantum Hamiltonian with 2-body interactions, i.e., a quadratic unconstrained binary optimization (QUBO) problem. The equilibrium market values of institutions after a sudden shock to the network can then be calculated via adiabatic quantum computation and, more generically, by quantum annealers. Our procedure could be implemented on near-term quantum processors, thus providing a potentially more efficient way to assess financial equilibrium and predict financial crashes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

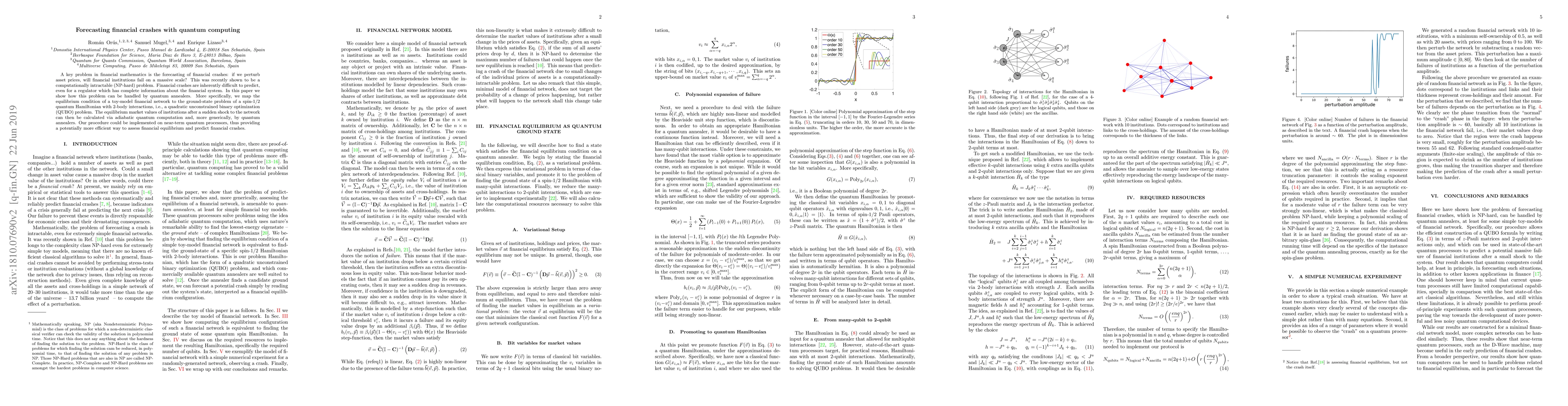

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTowards Prediction of Financial Crashes with a D-Wave Quantum Computer

Xi Chen, Lucas Lamata, José D. Martín-Guerrero et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)