Authors

Summary

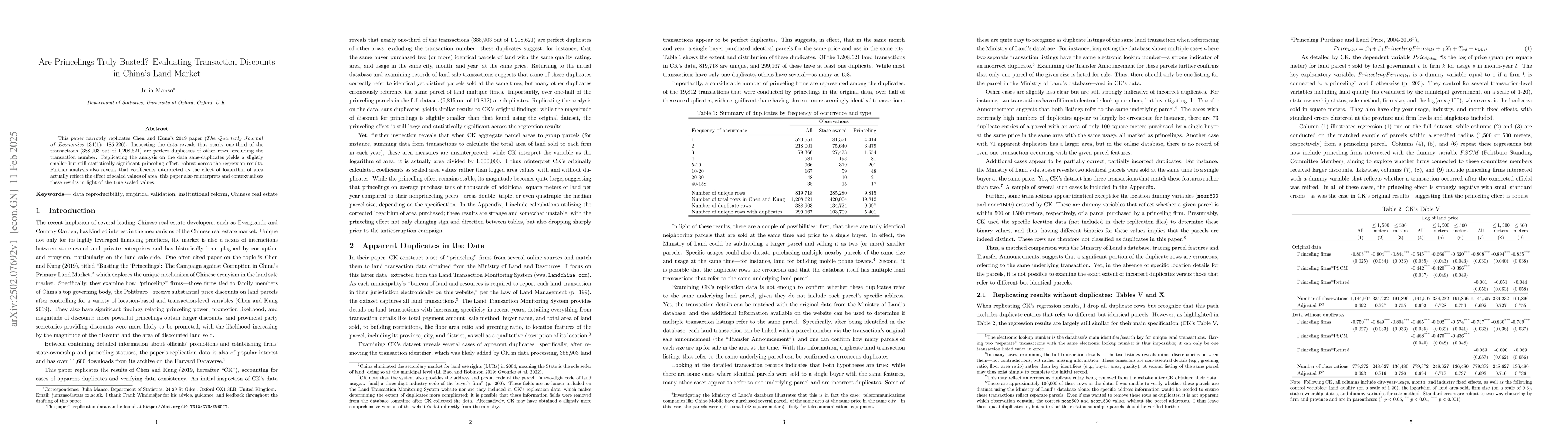

This paper narrowly replicates Chen and Kung's 2019 paper ($The$ $Quarterly$ $Journal$ $of$ $Economics$ 134(1): 185-226). Inspecting the data reveals that nearly one-third of the transactions (388,903 out of 1,208,621) are perfect duplicates of other rows, excluding the transaction number. Replicating the analysis on the data sans-duplicates yields a slightly smaller but still statistically significant princeling effect, robust across the regression results. Further analysis also reveals that coefficients interpreted as the effect of logarithm of area actually reflect the effect of scaled values of area; this paper also reinterprets and contextualizes these results in light of the true scaled values.

AI Key Findings

Generated Jun 11, 2025

Methodology

This study replicates and re-analyzes Chen and Kung's (2019) research on China's land market, focusing on transaction discounts for princelings. It identifies and corrects data issues, including duplicate transactions and misinterpretation of area measurements.

Key Results

- After removing duplicates, the princeling effect remains statistically significant but shrinks in magnitude, indicating a smaller advantage in land purchases.

- The misinterpretation of area as log(area) leads to erroneous results, especially affecting the economic significance of the princeling effect.

- The anticorruption campaign's impact on reducing princeling discounts is less clear-cut when duplicates are removed, with differences in land purchase volumes between princelings and non-princelings dropping before 2012.

- Recalculating with corrected log(area) values shows substantial differences in results, with princeling firms purchasing significantly more land than originally estimated, especially when connected to Politburo Standing Committee members or retired officials.

- The large percentage increases in land purchases by princeling firms, as calculated with the erroneous method, are nonsensical and likely reflect high variability in parcel sizes and sensitivity to data issues.

Significance

This research highlights the importance of accurate data handling and interpretation in economic studies, particularly in fields like land market analysis where small errors can lead to significant misinterpretations.

Technical Contribution

The paper corrects misinterpretations in Chen and Kung's (2019) analysis, demonstrating the importance of accurate data handling and interpretation in econometric studies.

Novelty

This research distinguishes itself by meticulously identifying and rectifying data errors in an existing study, providing a corrected analysis that reveals different insights into the princeling effect in China's land market.

Limitations

- The study is limited by the availability and quality of the original dataset, which contains a high percentage of zero values and duplicate entries.

- The results' sensitivity to data issues raises questions about the robustness of conclusions drawn from similar datasets without thorough error checking.

Future Work

- Further investigation is needed to determine the true causal impact of the anticorruption campaign on princeling land purchase discounts.

- Researchers should prioritize data quality checks and transparent reporting of data preprocessing steps in similar studies.

Paper Details

PDF Preview

No citations found for this paper.

Comments (0)