Summary

Identical products being sold at different prices in different locations is a common phenomenon. Price differences might occur due to various reasons such as shipping costs, trade restrictions and price discrimination. To model such scenarios, we supplement the classical Fisher model of a market by introducing {\em transaction costs}. For every buyer $i$ and every good $j$, there is a transaction cost of $\cij$; if the price of good $j$ is $p_j$, then the cost to the buyer $i$ {\em per unit} of $j$ is $p_j + \cij$. This allows the same good to be sold at different (effective) prices to different buyers. We provide a combinatorial algorithm that computes $\epsilon$-approximate equilibrium prices and allocations in $O\left(\frac{1}{\epsilon}(n+\log{m})mn\log(B/\epsilon)\right)$ operations - where $m$ is the number goods, $n$ is the number of buyers and $B$ is the sum of the budgets of all the buyers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

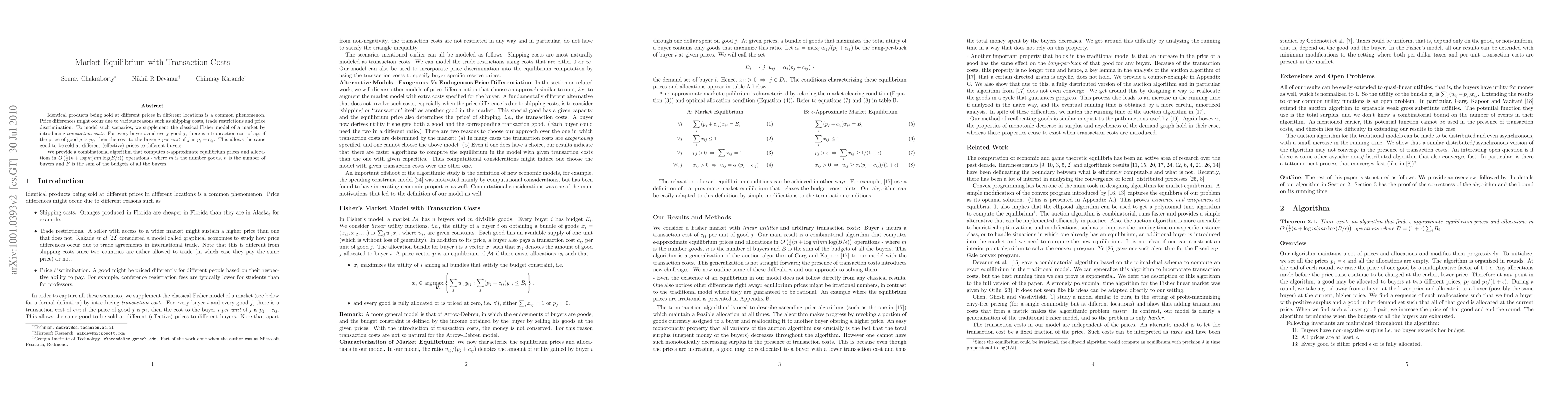

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersContinuous-time Equilibrium Returns in Markets with Price Impact and Transaction Costs

Michail Anthropelos, Constantinos Stefanakis

| Title | Authors | Year | Actions |

|---|

Comments (0)