Summary

We study risk-sharing economies where heterogenous agents trade subject to quadratic transaction costs. The corresponding equilibrium asset prices and trading strategies are characterised by a system of nonlinear, fully-coupled forward-backward stochastic differential equations. We show that a unique solution generally exists provided that the agents' preferences are sufficiently similar. In a benchmark specification with linear state dynamics, the illiquidity discounts and liquidity premia observed empirically correspond to a positive relationship between transaction costs and volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

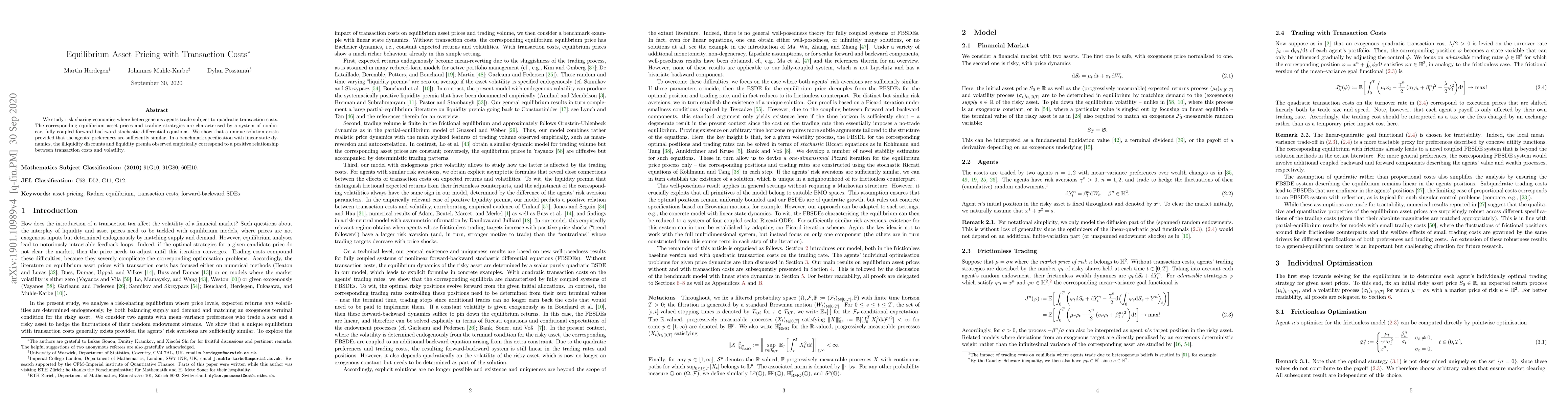

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)