Summary

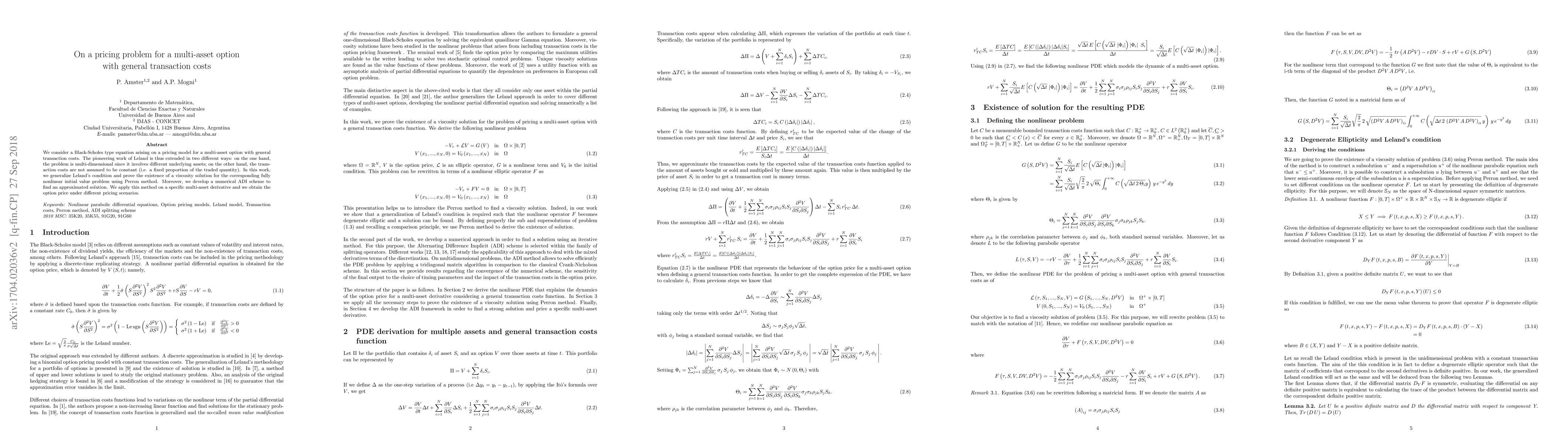

We consider a Black-Scholes type equation arising on a pricing model for a multi-asset option with general transaction costs. The pioneering work of Leland is thus extended in two different ways: on the one hand, the problem is multi-dimensional since it involves different underlying assets; on the other hand, the transaction costs are not assumed to be constant (i.e. a fixed proportion of the traded quantity). In this work, we generalize Leland's condition and prove the existence of a viscosity solution for the corresponding fully nonlinear initial value problem using Perron method. Moreover, we develop a numerical ADI scheme to find an approximated solution. We apply this method on a specific multi-asset derivative and we obtain the option price under different pricing scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)