Authors

Summary

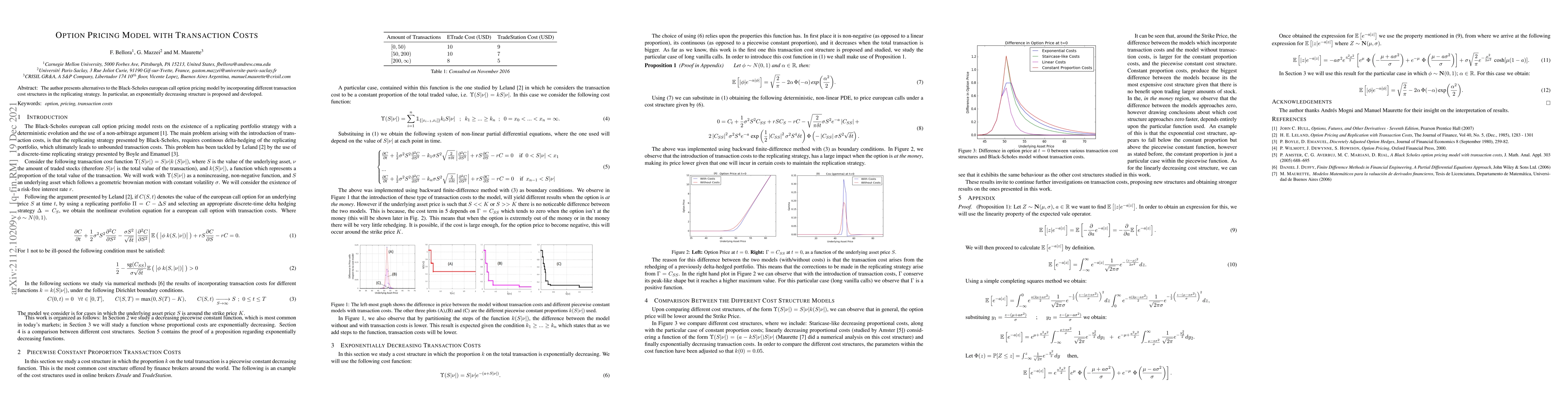

The author presents alternatives to the Black-Scholes european call option pricing model by incorporating different transaction cost structures in the replicating strategy. In particular, an exponentially decreasing structure is proposed and developed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)