Summary

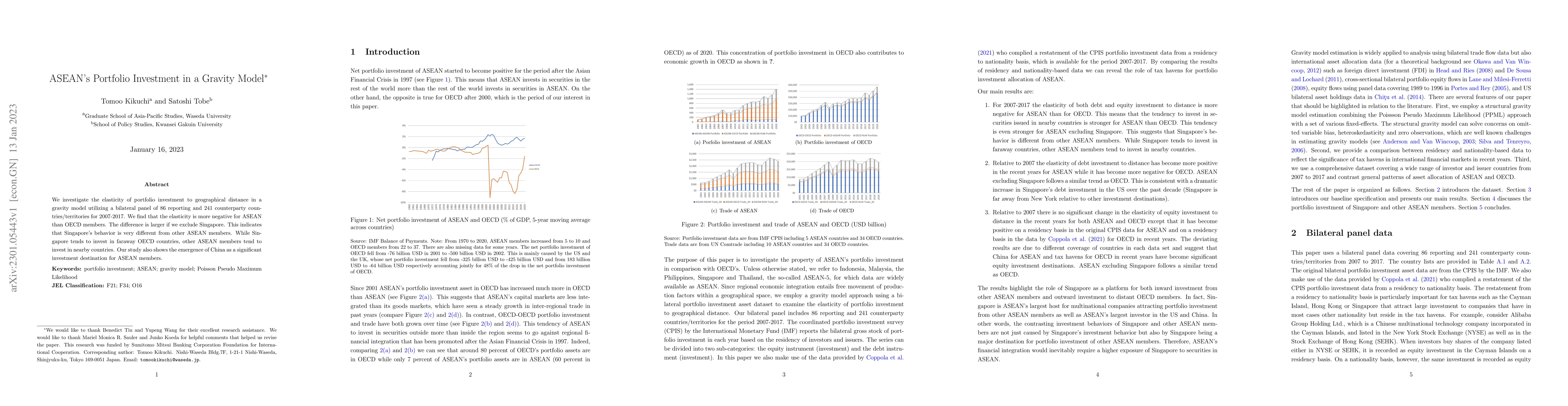

We investigate the elasticity of portfolio investment to geographical distance in a gravity model utilizing a bilateral panel of 86 reporting and 241 counterparty countries/territories for 2007-2017. We find that the elasticity is more negative for ASEAN than OECD members. The difference is larger if we exclude Singapore. This indicates that Singapore's behavior is very different from other ASEAN members. While Singapore tends to invest in faraway OECD countries, other ASEAN members tend to invest in nearby countries. Our study also shows the emergence of China as a significant investment destination for ASEAN members.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)