Summary

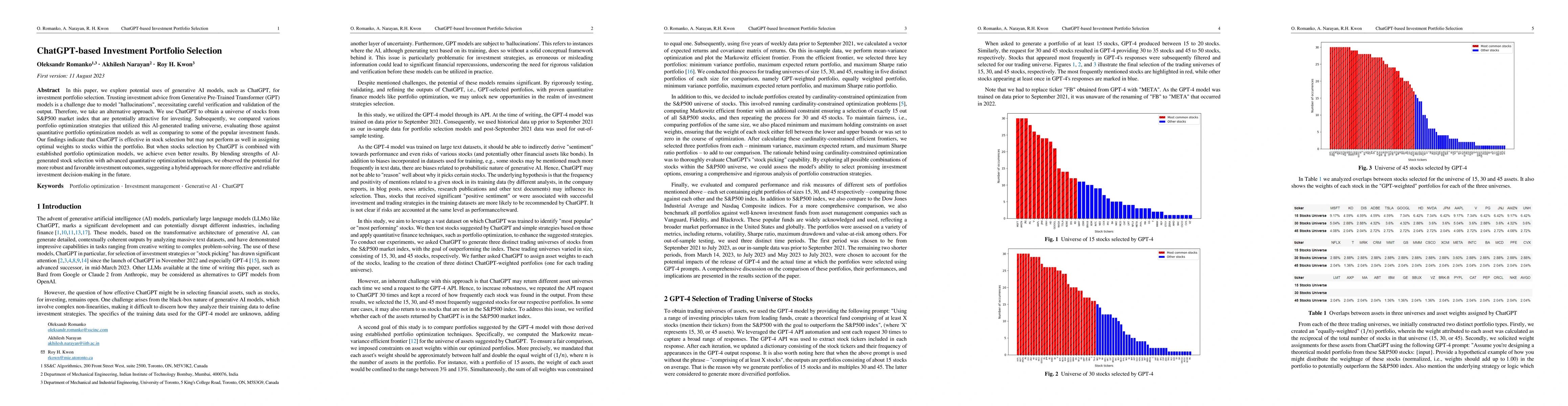

In this paper, we explore potential uses of generative AI models, such as ChatGPT, for investment portfolio selection. Trusting investment advice from Generative Pre-Trained Transformer (GPT) models is a challenge due to model "hallucinations", necessitating careful verification and validation of the output. Therefore, we take an alternative approach. We use ChatGPT to obtain a universe of stocks from S&P500 market index that are potentially attractive for investing. Subsequently, we compared various portfolio optimization strategies that utilized this AI-generated trading universe, evaluating those against quantitative portfolio optimization models as well as comparing to some of the popular investment funds. Our findings indicate that ChatGPT is effective in stock selection but may not perform as well in assigning optimal weights to stocks within the portfolio. But when stocks selection by ChatGPT is combined with established portfolio optimization models, we achieve even better results. By blending strengths of AI-generated stock selection with advanced quantitative optimization techniques, we observed the potential for more robust and favorable investment outcomes, suggesting a hybrid approach for more effective and reliable investment decision-making in the future.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersGoal-based portfolio selection with mental accounting

Erhan Bayraktar, Bingyan Han

DeepClair: Utilizing Market Forecasts for Effective Portfolio Selection

Jinho Lee, Donghee Choi, Mogan Gim et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)