Summary

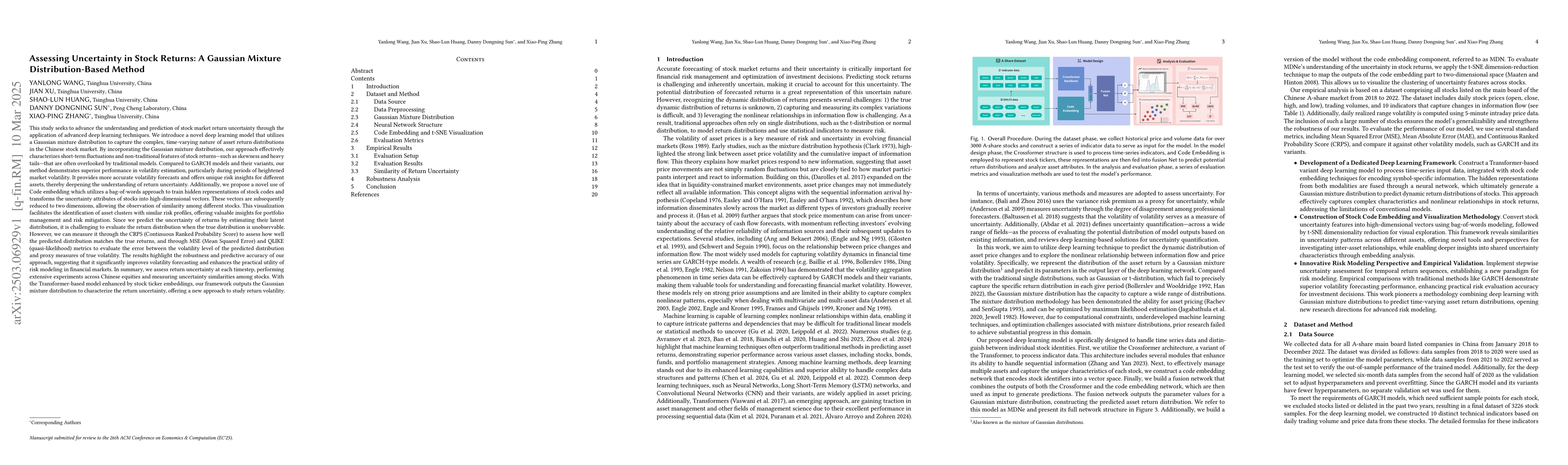

This study seeks to advance the understanding and prediction of stock market return uncertainty through the application of advanced deep learning techniques. We introduce a novel deep learning model that utilizes a Gaussian mixture distribution to capture the complex, time-varying nature of asset return distributions in the Chinese stock market. By incorporating the Gaussian mixture distribution, our approach effectively characterizes short-term fluctuations and non-traditional features of stock returns, such as skewness and heavy tails, that are often overlooked by traditional models. Compared to GARCH models and their variants, our method demonstrates superior performance in volatility estimation, particularly during periods of heightened market volatility. It provides more accurate volatility forecasts and offers unique risk insights for different assets, thereby deepening the understanding of return uncertainty. Additionally, we propose a novel use of Code embedding which utilizes a bag-of-words approach to train hidden representations of stock codes and transforms the uncertainty attributes of stocks into high-dimensional vectors. These vectors are subsequently reduced to two dimensions, allowing the observation of similarity among different stocks. This visualization facilitates the identification of asset clusters with similar risk profiles, offering valuable insights for portfolio management and risk mitigation. Since we predict the uncertainty of returns by estimating their latent distribution, it is challenging to evaluate the return distribution when the true distribution is unobservable. However, we can measure it through the CRPS to assess how well the predicted distribution matches the true returns, and through MSE and QLIKE metrics to evaluate the error between the volatility level of the predicted distribution and proxy measures of true volatility.

AI Key Findings

Generated Jun 10, 2025

Methodology

The study introduces a deep learning model using a Gaussian mixture distribution to capture the complex, time-varying nature of asset return distributions in the Chinese stock market, outperforming GARCH models, especially during high volatility periods.

Key Results

- The proposed method demonstrates superior volatility estimation and forecasting accuracy compared to GARCH models and their variants.

- A novel use of code embedding transforms uncertainty attributes of stocks into high-dimensional vectors, visualized in two dimensions for identifying asset clusters with similar risk profiles.

Significance

This research enhances understanding and prediction of stock return uncertainty, offering valuable insights for portfolio management and risk mitigation strategies.

Technical Contribution

The study presents a deep learning model with a Gaussian mixture distribution to model stock return uncertainty, incorporating code embedding and t-SNE visualization for risk similarity analysis.

Novelty

The research combines deep learning techniques with Gaussian mixture distributions to better capture complex stock return dynamics, introducing code embedding for visualizing risk similarities among assets.

Limitations

- The true distribution of price changes is unobservable, so actual volatility is approximated using realized range volatility (RRV).

- Evaluation of the model's performance relies on proxy measures of actual volatility, which may not always align with market realities.

Future Work

- Explore the application of this method to other markets and asset classes.

- Investigate the impact of additional macroeconomic variables on model performance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)