Summary

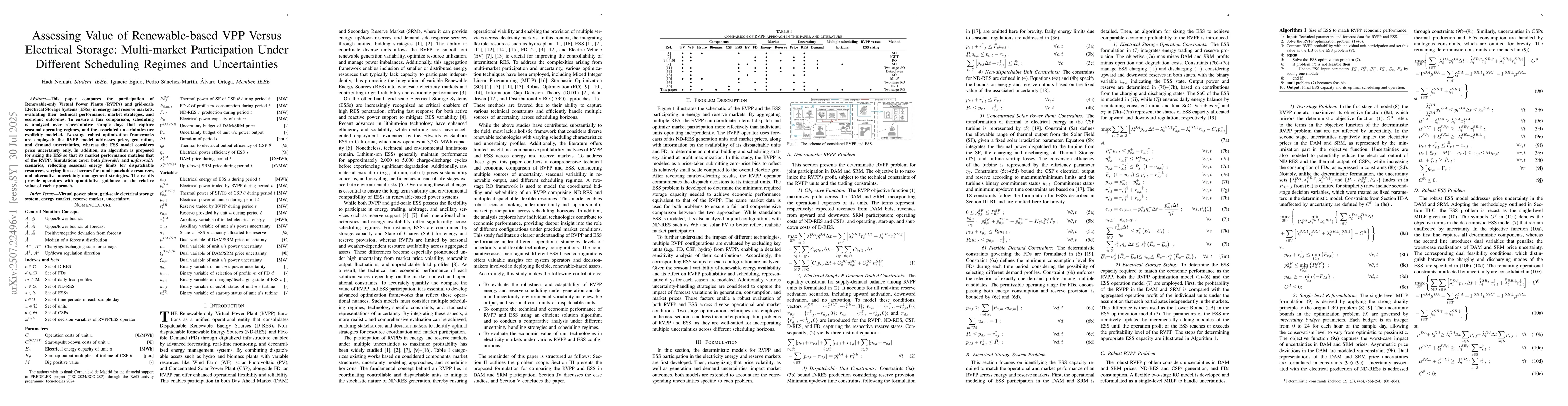

This paper compares the participation of Renewable-only Virtual Power Plants (RVPPs) and grid-scale Electrical Storage Systems (ESSs) in energy and reserve markets, evaluating their technical performance, market strategies, and economic outcomes. To ensure a fair comparison, scheduling is analyzed over representative sample days that capture seasonal operating regimes, and the associated uncertainties are explicitly modeled. Two-stage robust optimization frameworks are employed: the RVPP model addresses price, generation, and demand uncertainties, whereas the ESS model considers price uncertainty only. In addition, an algorithm is proposed for sizing the ESS so that its market performance matches that of the RVPP. Simulations cover both favorable and unfavorable scenarios, reflecting seasonal energy limits for dispatchable resources, varying forecast errors for nondispatchable resources, and alternative uncertainty-management strategies. The results provide operators with quantitative guidance on the relative value of each approach.

AI Key Findings

Generated Aug 01, 2025

Methodology

The research employs a two-stage robust optimization framework to compare the performance of Renewable-only Virtual Power Plants (RVPPs) and grid-scale Electrical Storage Systems (ESSs) in energy and reserve markets. The study considers scheduling over representative sample days capturing seasonal operating regimes and explicitly models associated uncertainties, including price, generation, and demand uncertainties.

Key Results

- RVPPs generally outperform individual unit participation, with profit advantages increasing under higher uncertainty.

- An ESS requires a significant capacity increase (96.8% and 180.9% under balanced and pessimistic strategies, respectively) to achieve comparable profitability with RVPPs.

- Integrating ESS with solar PV is more economically viable than with wind farm (WF) due to solar PV's lower energy variability.

- Seasonal flexibility is observed, with hydro units supplying most RVPP energy in winter, and summer operations relying mainly on solar PV and CSP.

- More conservative strategies reduce hourly energy sales but portfolio flexibility offsets these reductions, raising total profit.

Significance

This study provides operators with quantitative guidance on the relative value of RVPPs versus ESSs, crucial for designing efficient energy storage systems and virtual power plants in an uncertain renewable energy-based grid.

Technical Contribution

The paper proposes a two-stage robust optimization method to evaluate RVPPs and ESSs under various scheduling regimes and uncertainty scenarios, providing a comprehensive comparison of their technical performance, market strategies, and economic outcomes.

Novelty

The research introduces a novel approach to assess RVPPs and ESSs by explicitly modeling multiple uncertainties and employing a two-stage robust optimization framework, offering a more realistic evaluation of their performance compared to existing literature.

Limitations

- The study assumes fixed operational costs for different generation technologies.

- It does not consider the impact of technological advancements or policy changes on the performance of RVPPs and ESSs.

Future Work

- Investigate the impact of evolving technologies and policy changes on RVPP and ESS performance.

- Explore the integration of more advanced control strategies for ESSs to enhance their market participation.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDRL-Based Medium-Term Planning of Renewable-Integrated Self-Scheduling Cascaded Hydropower to Guide Wholesale Market Participation

Lei Wu, Neng Fan, Xianbang Chen et al.

Control Co-Design Under Uncertainty for Offshore Wind Farms: Optimizing Grid Integration, Energy Storage, and Market Participation

Wei Wang, Bowen Huang, Himanshu Sharma et al.

Optimal BESS Scheduling for Multi-Market Participation in the Nordics

Zeenat Hameed, Chresten Traeholt

No citations found for this paper.

Comments (0)