Authors

Summary

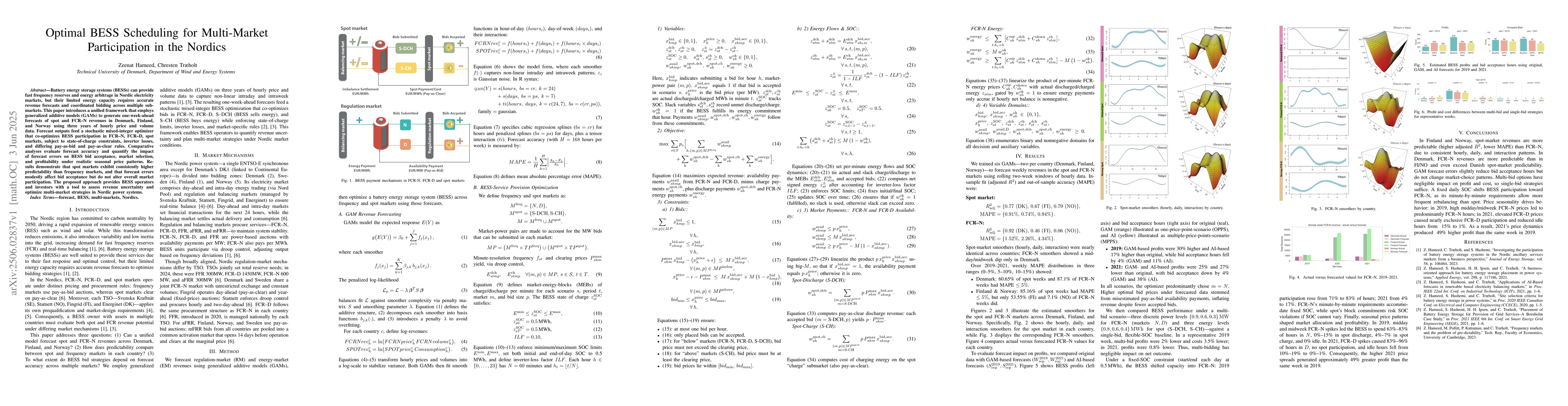

Battery energy storage systems BESSs can provide fast frequency reserves and energy arbitrage in Nordic electricity markets but their limited energy capacity requires accurate revenue forecasts and coordinated bidding across multiple submarkets. This paper introduces a unified framework that employs generalized additive models GAMs to generate one week ahead forecasts of spot and FCRN revenues in Denmark, Finland, and Norway using three years of hourly price and volume data. Forecast outputs feed a stochastic mixed integer optimizer that co-optimizes BESS participation in FCRN, FCRD, spot markets, subject to state of charge constraints, inverter losses, and differing pay as bid and pay as clear rules. Comparative analyses evaluate forecast accuracy and quantify the impact of forecast errors on BESS bid acceptance, market selection, and profitability under realistic seasonal price patterns. Results demonstrate that spot markets exhibit consistently higher predictability than frequency markets, and that forecast errors modestly affect bid acceptance but do not alter overall market participation. The proposed approach provides BESS operators and investors with a tool to assess revenue uncertainty and optimize multi market strategies in Nordic power systems.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBESS Participation Planning for Provision of Grid Services in Energy and Regulation Markets

Zeenat Hameed, Chresten Traeholt

Optimal Scheduling of Battery Storage Systems in the Swedish Multi-FCR Market Incorporating Battery Degradation and Technical Requirements

Nima Mirzaei Alavijeh, Rahmat Khezri, Mohammadreza Mazidi et al.

No citations found for this paper.

Comments (0)