Authors

Summary

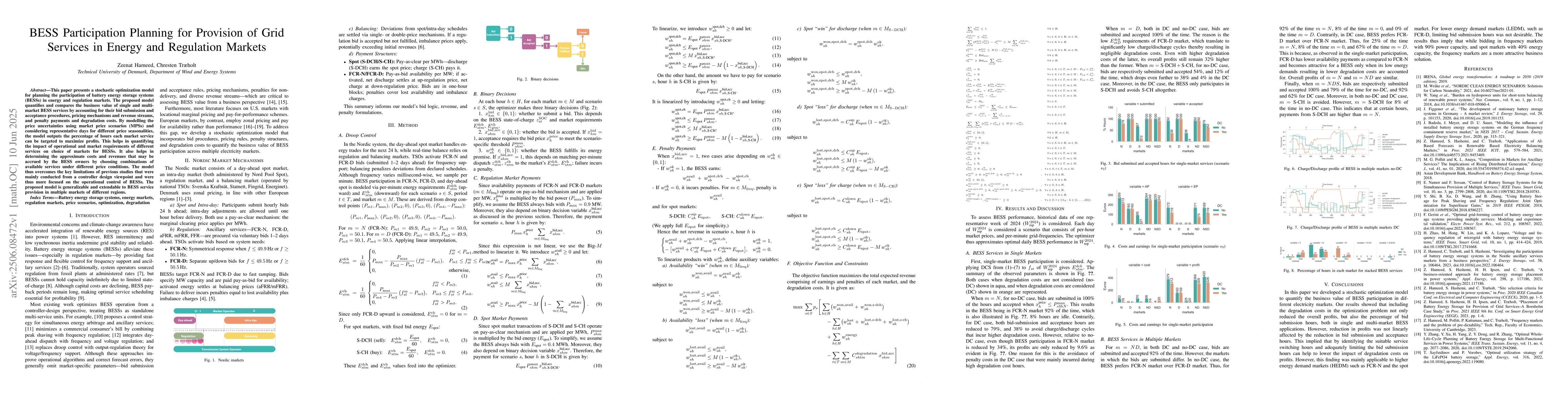

This paper presents a stochastic optimization model for planning the participation of battery energy storage systems (BESSs) in energy and regulation markets. The proposed model quantifies and compares the business value of single and multi-market BESS services by accounting for their bid submission and acceptance procedures, pricing mechanisms and revenue streams, and penalty payments and degradation costs. By modelling the price uncertainties using market price scenarios (MPSs) and considering representative days for different price seasonalities, the model outputs the percentage of hours each market service can be targeted to maximize profits. This helps in quantifying the impact of operational and market requirements of different services on choice of markets for BESSs. It also helps in determining the approximate costs and revenues that may be accrued by the BESS owners by choosing combinations of available services under different price conditions. The model thus overcomes the key limitations of previous studies that were mainly conducted from a controller design viewpoint and were thus more focused on the operational control of BESSs. The proposed model is generalizable and extendable to BESS service provision in multiple markets of different regions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Participation of Price-maker Battery Energy Storage Systems in Energy and Ancillary Services Markets Considering Degradation Cost

Meng Wu, Reza Khalilisenobari

Potential utilization of Battery Energy Storage Systems (BESS) in the major European electricity markets

Yu Hu, Miguel Armada, Maria Jesus Sanchez

Optimal BESS Scheduling for Multi-Market Participation in the Nordics

Zeenat Hameed, Chresten Traeholt

No citations found for this paper.

Comments (0)