Authors

Summary

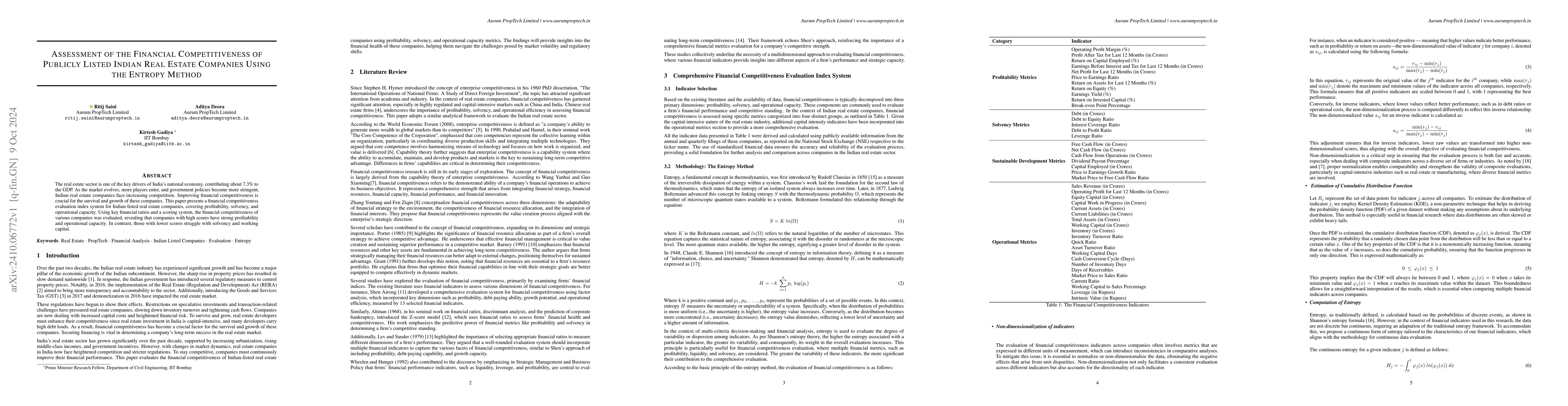

The real estate sector is one of the key drivers of India's national economy, contributing about 7.3\% to the GDP. As the market evolves, more players enter, and government policies become more stringent, Indian real estate companies face increasing competition. Improving financial competitiveness is crucial for the survival and growth of these companies. This paper presents a financial competitiveness evaluation index system for Indian-listed real estate companies, covering profitability, solvency, and operational capacity. Using key financial ratios and a scoring system, the financial competitiveness of various companies was evaluated, revealing that companies with high scores have strong profitability and operational capacity. In contrast, those with lower scores struggle with solvency and working capital.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

No citations found for this paper.

Comments (0)