Summary

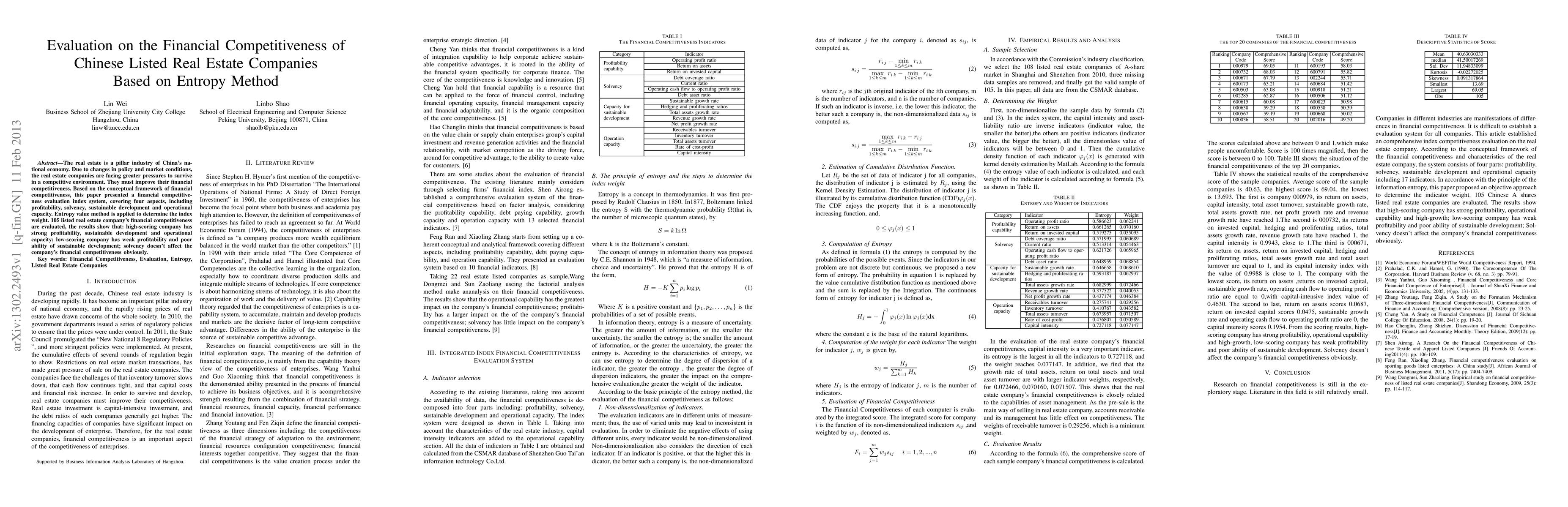

The real estate is a pillar industry of China's national economy. Due to changes in policy and market conditions, the real estate companies are facing greater pressures to survive in a competitive environment. They must improve their financial competitiveness. Based on the conceptual framework of financial competitiveness, this paper presented a financial competitiveness evaluation index system, covering four aspects, including profitability, solvency, sustainable development and operational capacity. Entropy value method is applied to determine the index weight. 105 listed real estate company's financial competitiveness are evaluated, the results show that: high-scoring company has strong profitability, sustainable development and operational capacity; low-scoring company has weak profitability and poor ability of sustainable development; solvency doesn't affect the company's financial competitiveness obviously.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAssessment of the Financial Competitiveness of Publicly Listed Indian Real Estate Companies Using the Entropy Method

Ritij Saini, Aditya Deora, Kirtesh Gadiya

| Title | Authors | Year | Actions |

|---|

Comments (0)