Authors

Summary

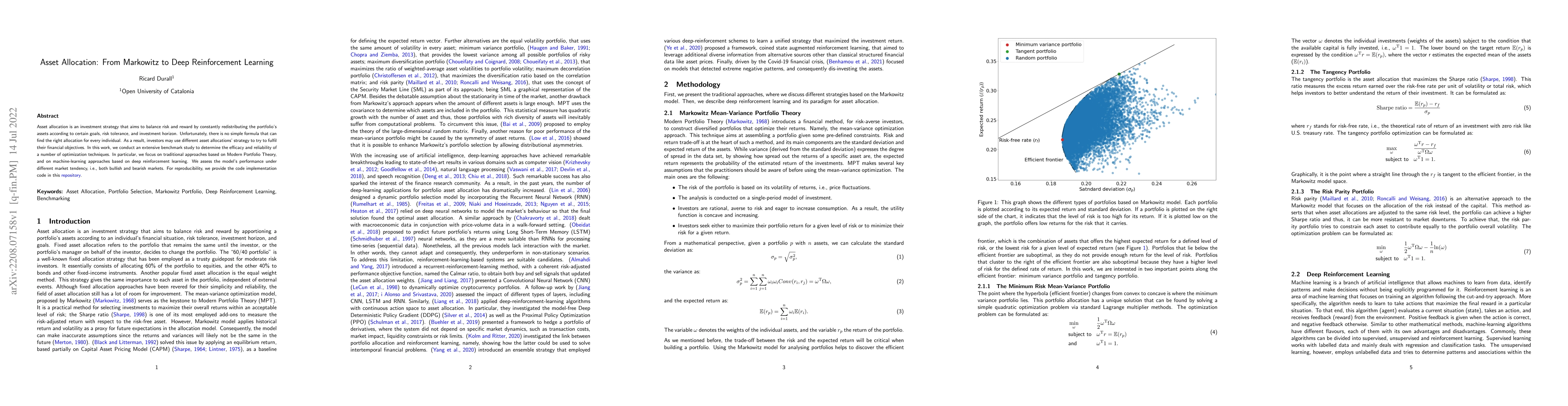

Asset allocation is an investment strategy that aims to balance risk and reward by constantly redistributing the portfolio's assets according to certain goals, risk tolerance, and investment horizon. Unfortunately, there is no simple formula that can find the right allocation for every individual. As a result, investors may use different asset allocations' strategy to try to fulfil their financial objectives. In this work, we conduct an extensive benchmark study to determine the efficacy and reliability of a number of optimization techniques. In particular, we focus on traditional approaches based on Modern Portfolio Theory, and on machine-learning approaches based on deep reinforcement learning. We assess the model's performance under different market tendency, i.e., both bullish and bearish markets. For reproducibility, we provide the code implementation code in this repository.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDeep Reinforcement Learning for Asset Allocation: Reward Clipping

Jiwon Kim, Moon-Ju Kang, KangHun Lee et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)